- Lordstown Motors Corp has slashed its vehicle production forecasts in its earnings report.

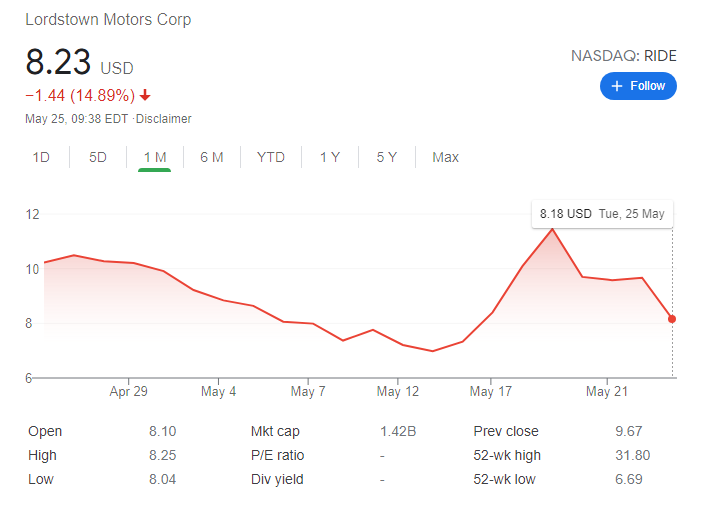

- NASDAQ: RIDE has tumbled over 10% on Tuesday.

- Critical support awaits shares at $7.76, then at $6.98

Have investors been taken for a ride? Those who bought shares of Lordstown Motors Corp (NASDAQ: RIDE) early last week are up for a nasty surprise on Tuesday. Equity of the electric vehicle automaker has been tumbling by over 15% to $8.15 at the time of writing, Compared to the May 19 peak of $11.45, the fall is even greater.

Lordstown’s main downside driver comes from the firm itself – slashing down production guidance for the remainder of 2021 by at least half. Reducing the projected amount of vehicles delivered is not unique to the Ohio-based company. The world is dealing with an acute shortage of semiconductors that are needed to make cars, whether using a combustion engine or an electric one. However, that is apparently not the reason.

Stay up to speed with hot stocks’ news!

CEO Stephen Burns said that the company had secured enough chips for the “foreseeable future” and added a few other worrying comments for investors. The company is wary of rising expenses due to a beta program, validation tests, and securing necessary parts for producing cards.

That has immediate implications – Lordstown will be seeking a capital raise and has already kicked off negotiations. One such backer could be General Motors, which is already working with the company for several years. Moreover, the facility used by the young startup was previously utilized by the giant.

The silver lining from the report was that the EV-maker already has some 30,000 purchase agreements for its cars. The burden of delivery is now the main challenge.

As the chart shows, RIDE stocks have not only lost their previous plateau of around $9.50, but also the late April one of just above $10. Another such flat area is the round $8 level seen early this month. Stronger support is at the mini-peak of $7.76, followed by a monthly trough of $6.98.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.