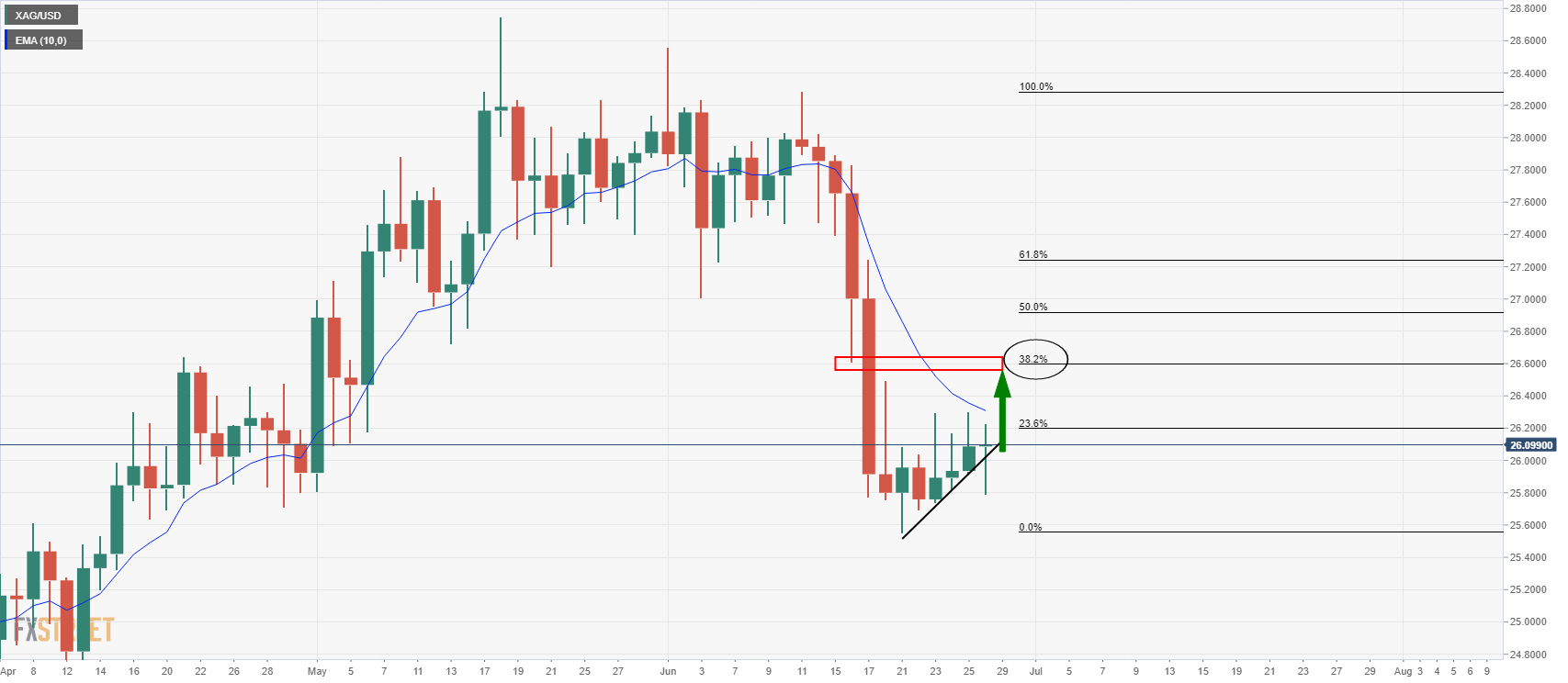

- Silver is attempting to move higher in a correction from the daily lows.

- Bulls eye a 38.2% Fibo retracement, but the covid spread is a potential weight.

At the time of writing, the price of silver is holding around flat in the latter part of the US session, but it has travelled between a range of $25.79 and $26.23.

The focus is on the upside as the precious metals, in general, correcting the US dollar’s dominance of late which came about from the latest Federal Reserve hawkish hold. Fed officials pencilled in two rate hikes for 2023.

Softer-than-expected inflation data last week did little to ease concerns about the Fed dialling down its monetary stimulus, as investors pared back bearish dollar bets.

Speculators decreased their net short dollar positions in the latest week, according to calculations by Reuters and US Commodity Futures Trading Commission data.

There was limited data to influence markets overnight but inflation themes persist as quarter-end approaches. The focus this week will be on China’s June PMI data and US NonFarm payrolls.

However, there is a worrying development in countries experiencing COVID-19 outbreaks which could fall into the hands of the US dollar bulls, regardless of the outcome in global data.

Currencies of countries that are exposed to the spread of the virus would be expected to come under pressure.

For instance, the Aussie is lower at the start of this week as lockdowns in Sydney intensified:

AUD/USD Price Analysis: 61.8% Fibo wasn’t to be, bears up the ante

Nevertheless, the technicals are tilted to the upside:

The bulls are looking to the 38.2% Fibonacci retracement target as $26.60. The 10-day EMA, however, is keeping a lid on the price.