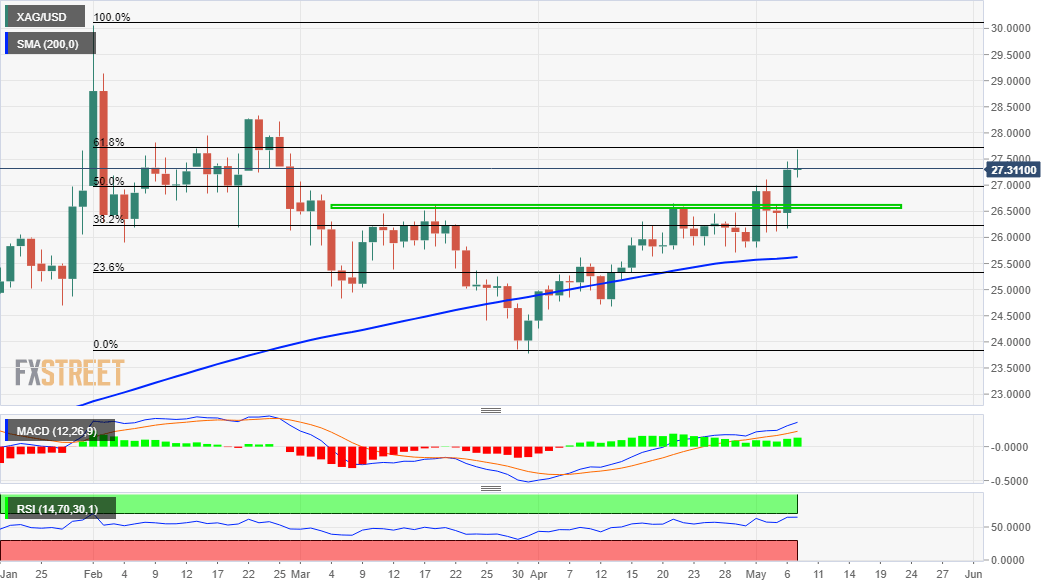

- Silver stalled its intraday positive move near a resistance marked by 61.8% Fibo. level.

- Slightly overbought RSI on hourly charts seemed to have prompted some profit-taking.

- The set-up supports prospects for the emergence of some dip-buying at lower levels.

Silver faded the post-NFP spike to the highest level since February 25 and dropped to fresh daily lows, around the $27.15 region in the last hour.

The intraday positive move stalled near the $27.65-70 region – a resistance marked by the 61.8% Fibonacci level of the $30.07-$23.78 downfall. This is followed by the $28.00 round-figure mark, which should now act as a key pivotal point for short-term traders.

Meanwhile, a modest US dollar rebound from one-week lows was seen as a key factor that prompted some profit-taking around the XAG/USD amid slightly overbought RSI on hourly charts. Hence, any subsequent fall might still be seen as an opportunity for bullish traders.

From current levels, the 50% Fibo. level, around the $26.95-90 area might protect the immediate downside. This is followed by the $26.60-50 strong horizontal resistance breakpoint, which if broken might accelerate the corrective slide to the $26.00 round figure.

The latter coincides with the 38.2% Fibo. level and should act as a strong near-term base for the XAG/USD. That said, a convincing break below will negate any near-term bullish bias, rather prompt some aggressive technical selling and turn the commodity vulnerable.

On the flip side, the daily swing highs, around the $27.65-70 area now seems to act as an immediate resistance ahead of the $28.00 mark. Some follow-through buying should pave the way for a move towards the $28.80-85 supply zone before the XAG/USD reclaims the $29.00 mark.