- Silver prices have started out flat and pressured below the 4-hour resistance.

- Bears are looking for a downside continuation below the 10-EMA support.

- Bulls will be keener on a break of 27.76.

The price of silver is under pressure and denying the bulls of a free lunch given the recent close below prior resistance

Meanwhile, the US dollar’s rise is capping the precious metals and XAG/USD lost 0.70% from a high of $28.07 to a low of $27.20 on Friday.

The dollar index, DXY, a measure of the greenback against a basket of six currencies, was 0.222% higher at 89.993 and was supported by solid US manufacturing data.

However, the index, which hit a four-month low earlier in the session, was on pace for a loss of 0.4% for the week as investors continued to speculate that the greenback would suffer from a lower for longer regime and while Europe’s recovery kicks in sooner than first anticipated.

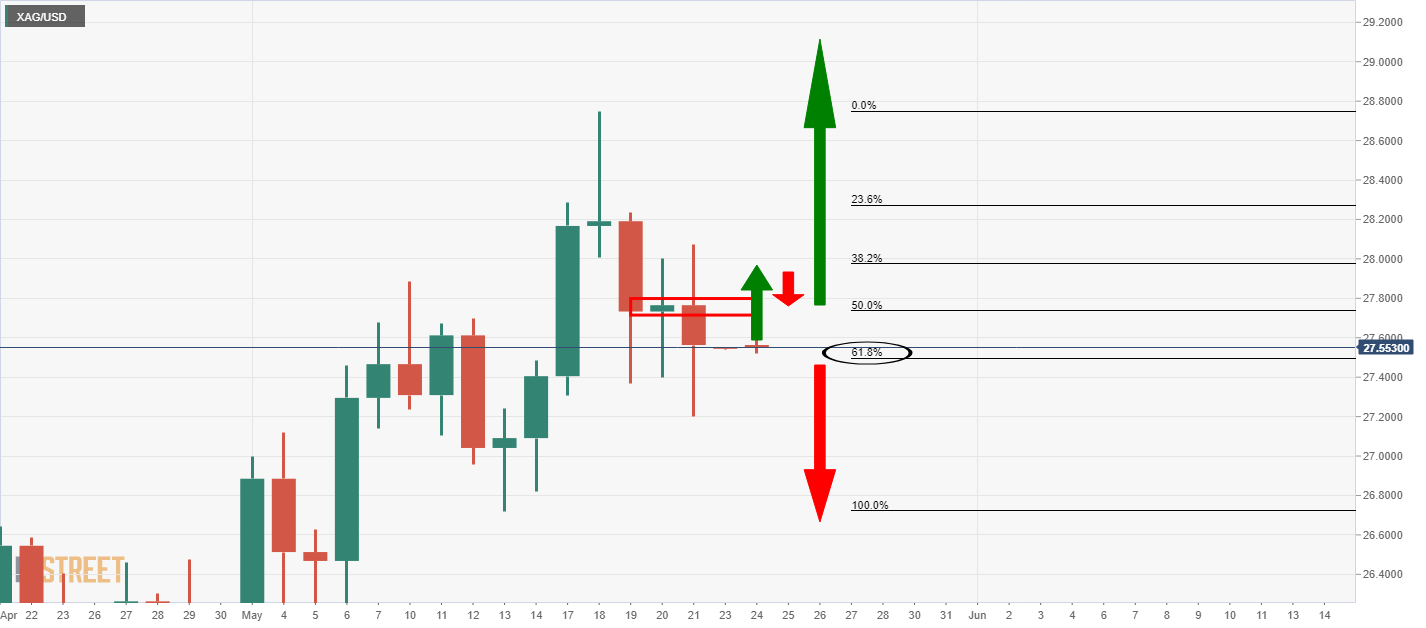

Technically, the price corrected a portion of Friday’s decline but has so far kept below the 4-hour resistance marked by the series of 4-hour lows from earlier in the week.

Bearish pressures could result in a downside continuation for the sessions ahead and see silver back below 27.00.

In doing so, the dynamic trend line support will be broken and the focus will be on $26.60 as the prior resistance structure.

On the upside, bulls will seek to replenish the weekly $28.75 highs in what will be a fresh daily impulse to the upside from a 61.8% Fibonacci retracement of the prior daily bullish impulse.