Value stocks have been on a tear over the past six months, as some growth stocks have fizzled out. But the value rally may still be at an early stage, according to two fund managers from different companies who hold small-cap and mid-cap stocks.

Justin Tugman of Janus Henderson Investors and Christian Stadlinger of Columbia Threadneedle Investments both made the case that the value rally will continue, especially for small-cap and mid-cap companies. The two mutual fund managers highlighted stocks that, they say, remain attractively priced.

At the bottom of this article are tables and charts showing how small- and mid-cap value stocks’ price-to-earnings ratios haven’t risen as much as those of the broad S&P indexes and their growth subsets.

Tugman co-manages the Janus Henderson Small Cap Value Fund

JSCOX,

-2.14%

with Craig Kempler, and also co-manages the Janus Henderson Mid Cap Value Fund

JMVAX,

-0.92%

with Kevin Preloger. The Small Cap Value Fund is rated four stars (out of five) by Morningstar, while the Mid Cap Value Fund has a three-star rating.

When discussing the broad market rally since the pandemic bottom in March 2020, Tugman said the unprecedented monetary and fiscal stimulus has pushed some investors to suspend “any common sense when it comes to valuation metrics.”

Following a long period during which growth stocks outperformed value, he believes investors’ expectations for a rapidly growing U.S. economy and rising interest rates will continue to bode well for value stocks. He pointed out that periods of outperformance for value stocks have historically stretched over several years.

Tugman said he and his colleagues tend to be “risk-averse.” When selecting new stocks for the portfolios they manage, they first consider downside risk, then focus on upside potential and come up with a risk/reward ratio. They steer clear of highly leveraged or unprofitable companies and those facing “binary events,” such as biotechnology developers holding trials.

Tugman named three value stocks he believes are attractive today:

-

Citizens Financial Group Inc.

CFG,

-3.64%

of Providence, R.I., is a regional bank with $183 billion in assets and about 1,000 branches in 11 states. Tugman called the stock’s valuation “attractive at roughly 11 times estimated 2021 earnings.” He said the bank’s credit quality was strong and that it was well positioned to benefit from the steepening yield curve. Citizens is one of the largest holdings of the Janus Henderson Mid Cap Value Fund. -

United Community Banks Inc.

UCBI,

-3.67%

is a holding of the Janus Henderson Small Cap Value Fund. It is based in Blairsville, Ga., has $17.8 billion in total assets, with branches in five states. The stock has a forward P/E ratio of 14.8, which is on the high side for a bank. “We do not think [that valuation is] egregious for a bank growing like they are,” Tugman said. He expects UCBI to continue growing its loan portfolio in the high single digits, which is an impressive organic growth rate for any bank. -

Another small-cap holding is Sunstone Hotel Investors Inc.

SHO,

-1.81%,

which is a real-estate investment trust that owns hotel buildings and leases them to operators licensed by Marriott, Hilton and other well-known brands. Tugman said hotel closures during the pandemic had caused a “cash burn,” but that Sunstone’s balance sheet was still healthy. With the industry beginning to reopen, he believes “SHO sets up well for the long term.”

Stadlinger is the lead manager for the Columbia Small Cap Value Fund II

NSVAX,

-2.54%,

and has been involved with the fund’s management since 2002. Jarl Ginsberg co-manages the fund, which is rated four stars by Morningstar.

During an interview, Stadlinger said that through 2019, small-cap growth stocks had been outperforming value for 10 years, because “when growth is scarce, the market pays up more for growth.” HE was referring to slow GDP growth in the U.S. But now economists polled by MarketWatch expect a 6% GDP growth rate for 2021.

“[T]here will be a whole lot more money being spent. When that happens, value stocks have historically outperformed,” he said.

The Columbia Small Cap Value Fund II holds about 100 stocks. Stadlinger said he and Ginsberg select value stocks they believe will turn into growth stocks as the companies’ earnings improve. “That’s how you get returns,” he said.

Companies held by the fund that Stadlinger expects to switch to growth from value include Sunstone Hotel Investors, which is also held by Janus Henderson and described above. “All the indicators are positive” for the company as the industry reopens at full strength, he said.

Four more companies mentioned by Stadlinger:

-

Herc Holdings Inc.

HRI,

-4.94%

rents construction and earth-moving equipment. With the economy improving, “utilization is picking up quite a bit,” Stadlinger said. The company is based in Florida and mainly operates in southern states, where commercial and residential construction activity is strong. And Stadlinger believes a large round of federal infrastructure spending is “doable.” -

Marriott Vacations Worldwide Corp.

VAC,

-0.94%

is a timeshare operator. This is an industry whose business model has changed, at least for such a large player. If you own a timeshare with Marriott Vacations, you earn points that can be used to make exchanges with other timeshare properties operated by the company. Stadlinger said that unlike hotel operators, timeshare companies have continued to collect maintenance fees from most customers during the pandemic. So they have been undervalued. And now, as the travel industry reopens, various other revenue streams are resuming, including restaurant and pool fees, he said. -

Atlantic Union Bankshares Corp.

AUB,

-4.00%

is based in Richmond, Va., and has $19.6 billion in assets and 129 branches in three states. Stadllinger described AUB as the “largest independent bank left” in Virginia, with “very strong management” and good prospects for loan growth as the economy improves. He also believes the bank is a takeout target for J.P. Morgan Chase & Co.

JPM,

-1.55%

or Bank of America Corp.

BAC,

-0.96%

if they wish to have an expanded presence in the state. -

Ultra Clean Holdings Inc.

UCTT,

-5.27%

makes chemicals and equipment used by semiconductor manufacturers. The stock trades for 15.9 times the consensus earnings estimate among analysts polled by FactSet. Stadlinger called UCTT “cheap” because of the growth prospects in its industry. The chip-making business is booming.

Value vs growth

The broad stock market indexes are broken into overlapping value and growth groups. The value groups are larger, and the companies in them tend to have lower price-to-earnings and price-to-book ratios, as well as lower sales growth rates. The growth groups tend to have higher price valuations and higher growth rates. The companies in both camps show characteristics of both, or at least did the last time the indexes were rebalanced, which happens annually.

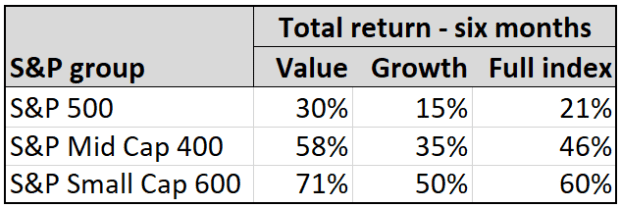

Here are total returns for the three broad S&P indexes over the past six months, along with those of their value and growth subsets:

(FactSet)

So for all three indexes, the value groups have been in the lead for the past six months, as stocks have performed very well across the board.

But a long-term look at forward price-to-earnings valuations for exchange traded funds that track the groups shows a remarkable trend — for mid-cap and small-cap stocks, P/E valuations for the value groups still appear relatively low.

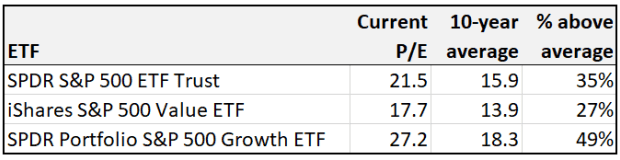

First, let’s look at large-caps — here are the SPDR S&P 500 ETF Trust

SPY,

-0.05%,

the iShares S&P 500 Value ETF

IVE,

-0.26%

and the SPDR Portfolio S&P 500 Growth ETF

SPYG,

+0.09%

:

(FactSet)

For the large-caps, P/E valuations are high across the board, but less so for value.

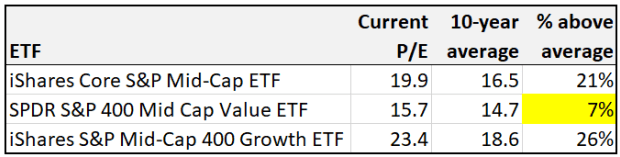

For mid-caps, here are P/E comparisons for the iShares Core S&P Mid Cap ETF

IJH,

-1.82%,

the SPDR S&P 400 Mid Cap Value ETF

MDYV,

-1.76%

and the iShares S&P 500 Mid-cap 400 Growth ETF

IJK,

-1.89%

:

(FactSet)

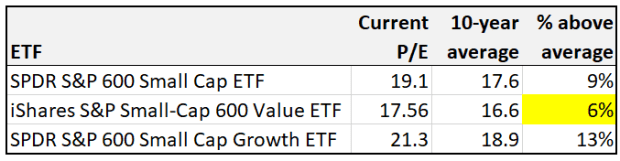

For small-cap stocks, here are P/E comparisons for the SPDR S&P 600 Small Cap ETF

SLY,

-2.43%,

the iShares S&P Small-Cap 600 Value ETF

IJS,

-2.59%

and the SPDR S&P 600 Small Cap Growth ETF

SLYG,

-2.42%

:

(FactSet)

So for the small- and mid-cap value stocks, forward P/E ratios aren’t very high when compared with 10-year averages, even after such a powerful rally.

Don’t miss: 10 highest-yielding dividend-stock ETFs for a low-rate world