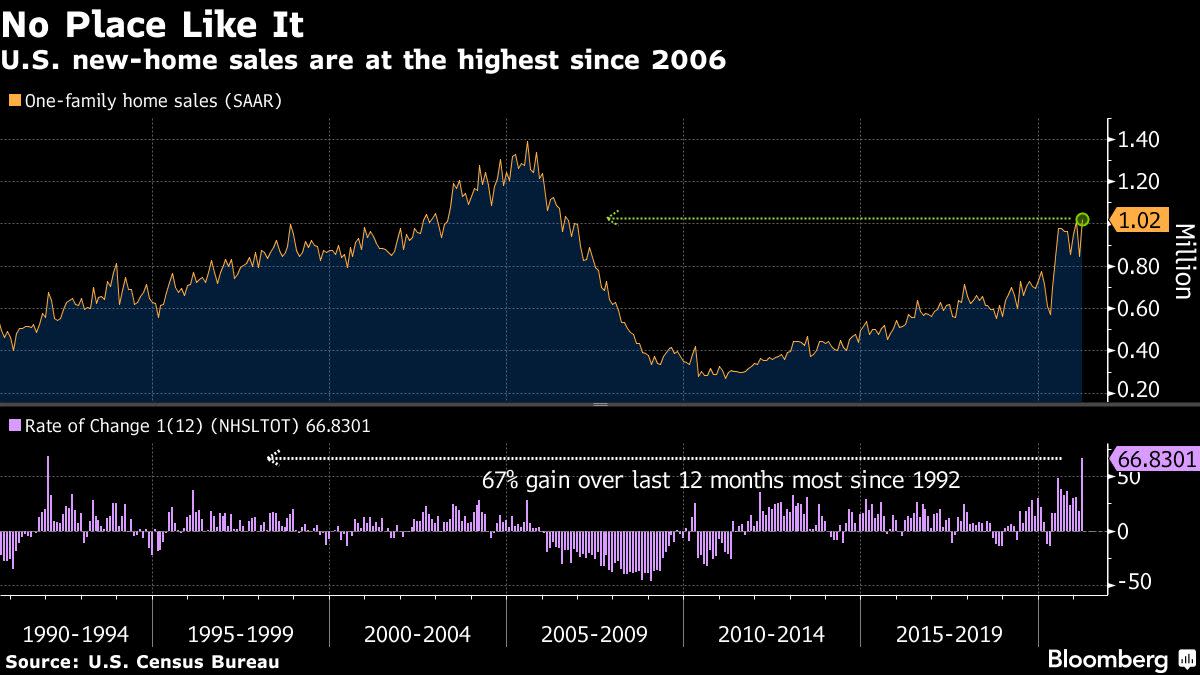

(Bloomberg) — Stocks are set to kick off the week on the front foot in Asia after strong U.S. earnings enforced evidence the recovery from the pandemic is gathering speed. Currencies were steady early Monday.Futures pointed higher in Japan, Australia and Hong Kong after most major groups in the S&P 500 advanced Friday. U.S. new-home sales rebounded in March to the highest since 2006, while output at manufacturers and service providers reached a record high in April. The 10-year Treasury yield hovered below 1.6%.The dollar maintained losses against major peers in early trading.Focus turns to the Federal Reserve meeting this week, with policy makers reiterating that they are in no hurry to withdraw support even as the U.S. economy rebounds.“The markets have clearly had some time to digest the data flows coming in,” Amir Khan, Saudi National Bank’s senior economist, said on Bloomberg TV. After concerns about a pick-up in inflation, “the markets are starting to get sense of where the U.S. economy is likely to come in, I think they are starting to get a little bit more comfortable in terms of how to position themselves,” he said.Equities whipsawed last week amid a flare-up in global coronavirus cases and news that the White House plans to propose almost doubling the capital-gains tax rate for the wealthy.Here are some key events to watch this week:Bloomberg Live hosts the Bloomberg Green Summit Monday through April 27Bank of Japan rate decision and Governor Haruhiko Kuroda briefing TuesdayFed Chair Jerome Powell holds a press conference Wednesday following the FOMC meetingJoe Biden makes his first address as president to a joint session of Congress WednesdayU.S. GDP is forecast to show robust 6% growth in the first quarter, bolstered by government stimulus ThursdayThese are some of the main moves in markets:StocksThe S&P 500 rose 1.1% FridayNikkei 225 futures rose 0.7%Australia’s S&P/ASX 200 Index futures added 0.6%Hong Kong’s Hang Seng Index futures rose 0.5% earlierCurrenciesThe yen was little changed at 107.94 per dollarThe offshore yuan was at 6.4875 per dollarThe Bloomberg Dollar Spot Index fell 0.4% FridayThe euro traded at $1.2093BondsThe yield on 10-year Treasuries rose two basis points to 1.56%CommoditiesWest Texas Intermediate crude rose 1.2% to $62.14 a barrelGold ended last week at $1,777.20 an ounceFor more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2021 Bloomberg L.P.