Wall Street analysts may be setting the bar too high when it comes to future corporate earnings, according to one market economist.

“The implication is that [earnings per share] will have to perform even better than analysts are forecasting in general between now and the end of 2022 if the S&P 500 is to get a boost from this source,” wrote John Higgins, chief markets economist at Capital Economics, in a note. “We think that is unlikely, despite our positive view of the U.S. economy.”

Counterpoint: Why it may still be early days for the stock-market reflation trade

Typically, Wall Street’s finest are seen setting the bar low when it comes to corporate earnings. But optimistic expectations fueled by visions of a surging U.S. economy as the COVID-19 pandemic fades into the rearview mirror courtesy of vaccines has sent future earnings forecasts solidly higher.

In fact, “they seem to be very optimistic even allowing for the fact that the U.S. economy is likely to fare especially well during the rest of this year and next,” Higgins said.

For the companies that make up the S&P 500 index

SPX,

-0.01%,

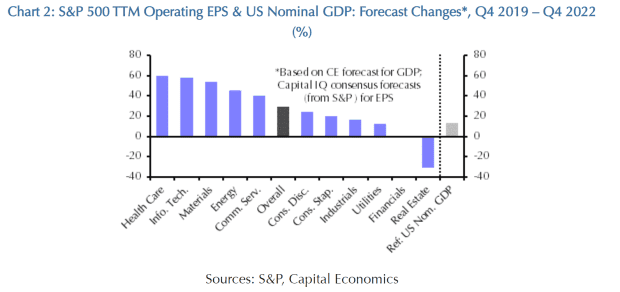

the consensus forecast for trailing 12-month operating earnings per share, or EPS, in the fourth quarter of 2022 are around 29% above actual trailing 12-month operating EPS in the fourth quarter of 2019 — the last full quarter before the COVID-19 pandemic hit the global economy (see chart below), he noted, observing that it’s also more than Capital Economics’ forecasts for nominal U.S. gross domestic product growth in the same period.

Capital Economics

It isn’t a uniform picture across sectors, Higgins acknowledged. The gap between forecast Q4 2022 and actual Q4 2019 12-month trailing operating EPS remains substantially negative for real estate and slightly negative for financials. But it’s positive by more than 50% in three other sectors: healthcare, information technology and materials.

Companies have largely had no problem topping Wall Street expectations for the first quarter so far this earnings reporting season. But just because analysts appear to have underestimated the rebound in earnings in the first quarter “doesn’t mean that they are being too conservative about the future,” Higgins said.

Despite strong earnings results this quarter, stocks have traded more or less sideways, albeit at or near record levels, as the reporting season moved into full swing this week. The Dow Jones Industrial Average

DJIA,

-0.43%

remains up 10.7% so far in 2021, while the S&P 500 has rallied around 11.5%. The Nasdaq Composite

COMP,

-0.15%

is up more than 9%, setting its first record close since February earlier this week.

The price investors are willing to pay for earnings already stands at a historically high level, Higgins noted and it’s unlikely to rise significantly if, as Higgins expects, long-dated yields on Treasury inflation-protected securities, or TIPS, see a significant rise and investors get the sense that the scope is limited for an offsetting drop in credit spreads — the difference between yields on corporate debt and Treasurys.

That’s why the S&P 500, which is currently trading around 4,190, is likely to see little more upside in 2021, Higgins said, noting Capital Economics has a year-end forecast of 4,200, and may struggle to score small gains in 2022 and 2023.