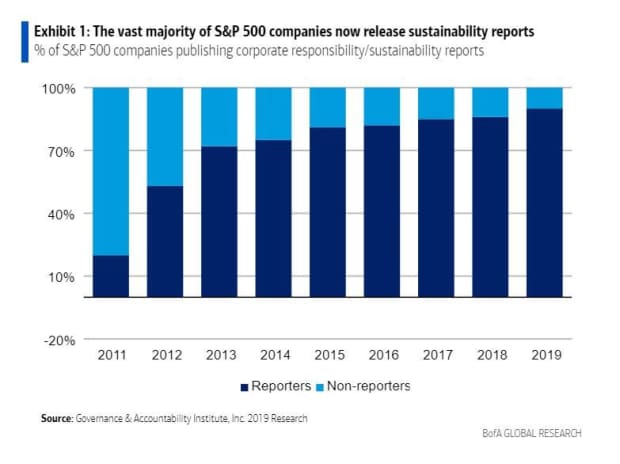

Most companies listed in the S&P 500 are more transparent about their exposure to climate-change risk than a decade ago, while investors appear slightly more astute in pricing these stocks based on the changes expected to come with a warming planet.

For Earth Day, the Bank of America equity and quant strategy team, led by Savita Subramanian and Marisa Sullivan, created a punch list highlighting the “surprising greening” of the S&P 500

SPX,

+0.64%.

The broad index is enjoying a nearly 11% gain in the year to date and has surged 49% over the past year.

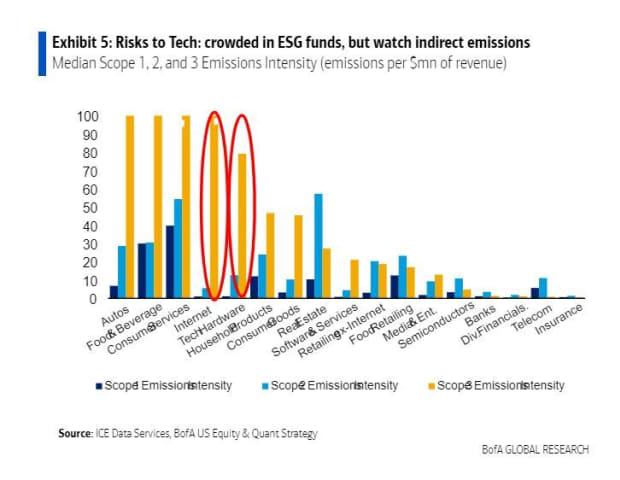

The bulk of S&P 500-linked emissions — 70% — are generated by industrials, utilities and energy combined, yet these stocks are less than 15% of the total index.

Read: ‘ESG’ funds have more energy stocks than you might think

From there, the “green” dissection of the index is more nuanced. Here are some of the BofA’s findings, in a series of charts.

Companies are making voluntary moves — although it took a push in many cases from investors, customers and employees — to both protect against and find opportunity in a global shift toward renewable energy, carbon capture technology, less reliance on oil

CL00,

-2.33%

and natural gas

NG00,

-1.36%,

smarter water use and more. Those actions precede what is seen as the potential for stricter regulation that will force companies to lay bare their climate-change risk and report it in a uniform way.

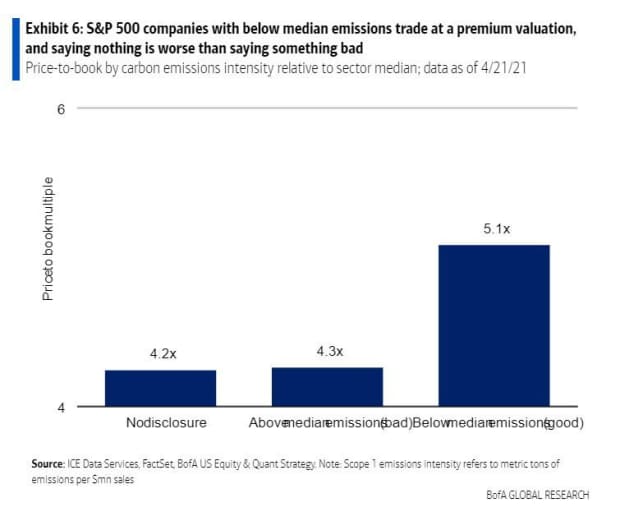

Companies with high emissions trade at more than a 15% discount to companies with low emissions. But saying nothing can be worse than saying something bad: companies that don’t disclose any emissions data trade at an even deeper discount, the analysts said.

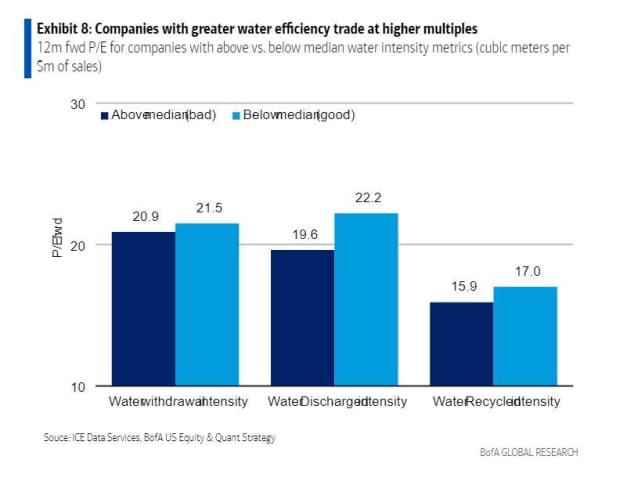

The BofA team tracked higher multiples for the S&P 500 stocks linked to low emissions, net zero targets and water efficiency.

And the analysts found that technology stocks

XSW,

+0.93%

RYT,

+1.16%,

which have been fixtures in environmental, social and government (ESG) funds and ETFs, aren’t all that “green” thanks to high indirect emissions.

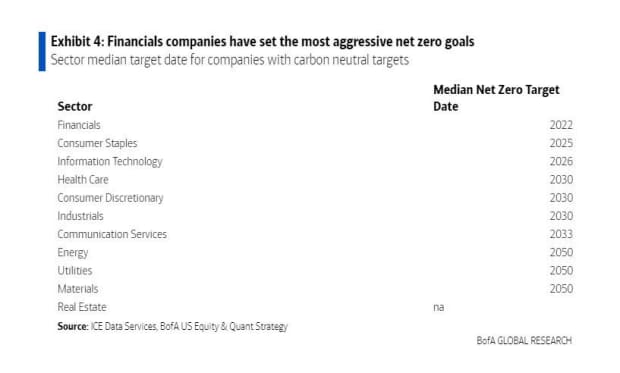

Of the companies that have carbon neutral targets, financial companies have set the quickest median target date, at 2022. This is followed by consumer staples companies, which have a median target date of 2025.

Financial firms have faced fresh scrutiny, however, that despite emissions pledges for their operations, banks continue to fund traditional energy sectors whose emissions pollute.

And: Banks are far more exposed to climate change than they’re disclosing

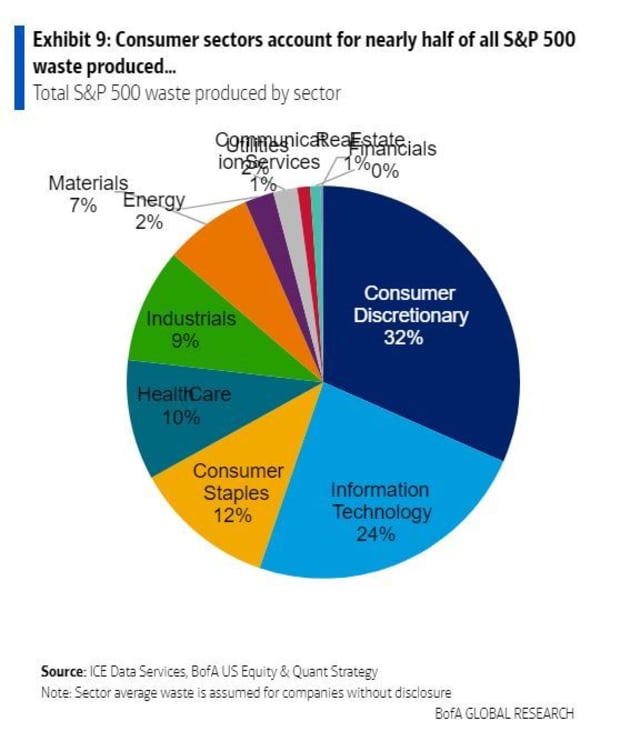

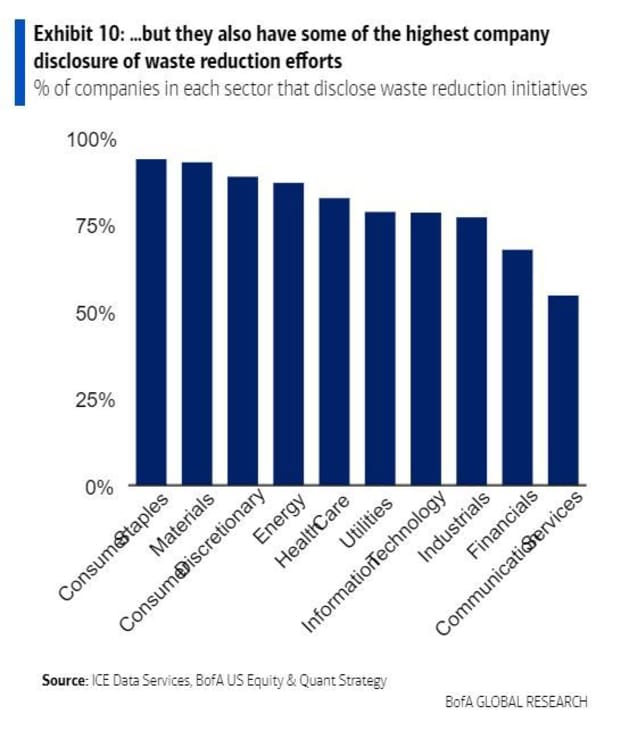

Consumer sectors make up half of the total waste generated by S&P 500 companies, while tech comes in second. For now, the consumer staples and discretionary sectors have among the highest percentage of companies with waste reduction initiatives, according to the BofA analysis.

With a broader lens on stock indexes, Arabesque, a sustainable-finance technology company, found that companies in 14 of the world’s largest stock indexes are generally lagging in efforts to hit the climate-change goals set out by major governing bodies.

Using data between 2015 and 2019 and its Temperatureä Score technology, the company included the FTSE 100

UKX,

+0.52%,

S&P 100

OEX,

+0.41%,

DAX

DAX,

+0.44%

and Nikkei

NIK,

-2.03%

in its research. It found that just under 25% of companies listed on all 14 indexes are aligned with meeting the 1.5 degree warming goal, a key focus of the United Nation’s COP26 and this week’s Joe Biden-led summit on climate.