- Ethereum cost hit a fresh all-time high $3,524 on May 4, however its own bull rally is far from being over.

- A slew of on-chain metrics such as system fees and daily busy addresses include credence into the bullish thesis.

- The rapidly increasing rate of DeFi has arrived at the stage it is beginning to compete with centralized fund associations.

Ethereum cost has become a subject of debate from the cryptocurrency ecosystem because it struck a brand new all-time large of $3,524 on May 4, even while Bitcoin cost is still recovering in the flash accident seen in April.

Contrary to popular belief, check out Ethereum’s on-chain metrics indicates that the current upswing is simply the start of a parabolic progress.

Though the fees needed to tack onto the Ethereum blockchain are comparatively large, most users adhere to ETH. The explanations for this are a lot, but it’s largely as a result of first-mover advantage.

Ethereum was the first to popularize the idea of’smart contract’ The move attracted interested programmers and consumers, that are, to the day, assembling on ETH and are liable for ecosystems that interact with this.

This type of phenomenon explains the neighborhood, be it, investors, users or developers, are drawn to Ethereum despite its inability to scale within the last couple of decades, implying an inherent requirement for what it has to offer you.

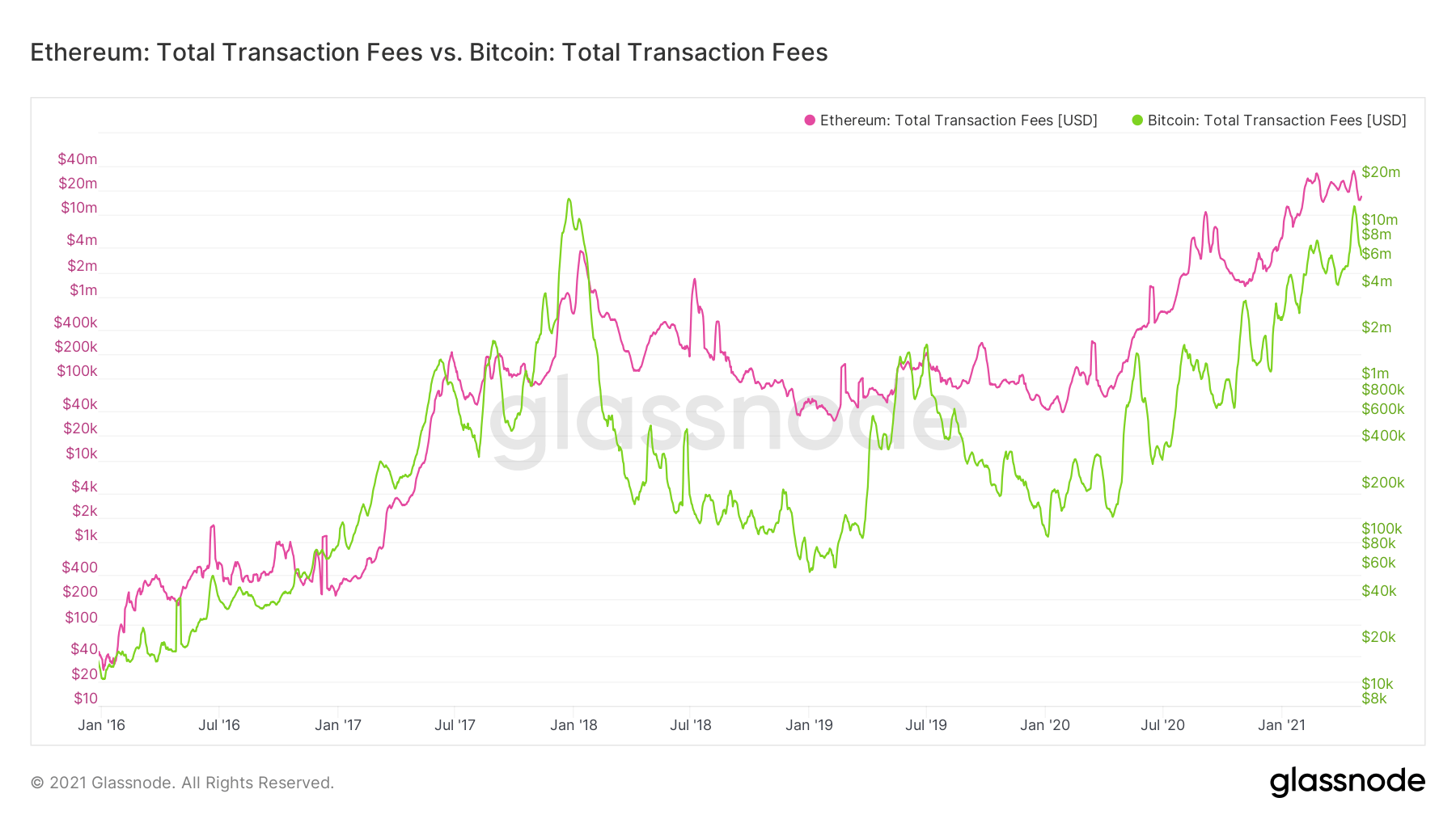

This requirement is allowable when appearing in the average of their total fees collected on the Ethereum blockchain, that has struck $32.8 million in May 2021.

The prices collected on Bitcoin hover about $12 million, which can be much behind Ether. Other popular platforms such as Uniswap, Compound, SushiSwap or Aave, have less than $3.5 million collected as charges, additional strengthening the need narrative explained previously.

Despite portraying increased need, high prices have ceased a vast majority of those retail investors from engaging. Hence, the newly accepted Ethereum Improvement Proposal (EIP)-1559 intends to handle high transaction fees methodically.

Once employed, EIP-1559 will lessen the random character of splurging on the community and create ETH deflationary by dividing the transaction fees into foundation fees and suggestions. However, the interesting part is the’used charges’ will probably be burnt, which makes it deflationary.

To put things into perspective, the monthly earnings earned by miners in April reach a whopping $1.65 billionout of which 43 percent was donated by transaction fees .

Moving ahead, Ethereum will burn off the ETH gathered from fees and decrease the expense to tack onto the blockchain, which might trigger a ton of adoption from retail.

Ethereum total fees collected chart

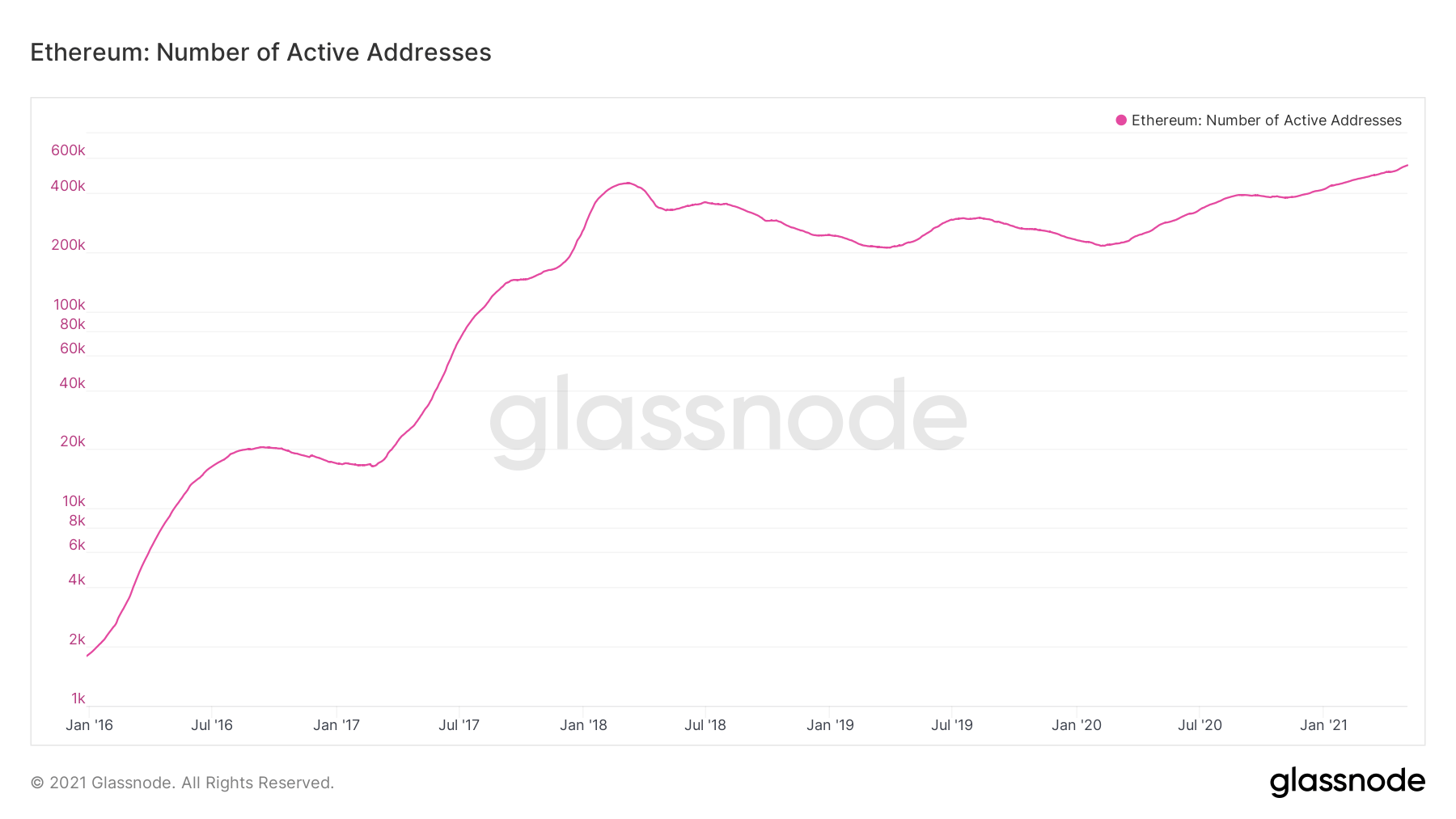

Additionally, the amount of addresses that are active transacting on a certain blockchain may be utilized as a proxy to this system’s requirement. It may gauge investors’ opinion and investment pursuits.

The 90-day daily busy addresses to your Ethereum network stand at 545,000, a brand new all-time large. The constant expansion signifies high use and interaction within the previous 3 months, further affirming the wise contract platform’s requirement.

Ethereum busy speeches graph

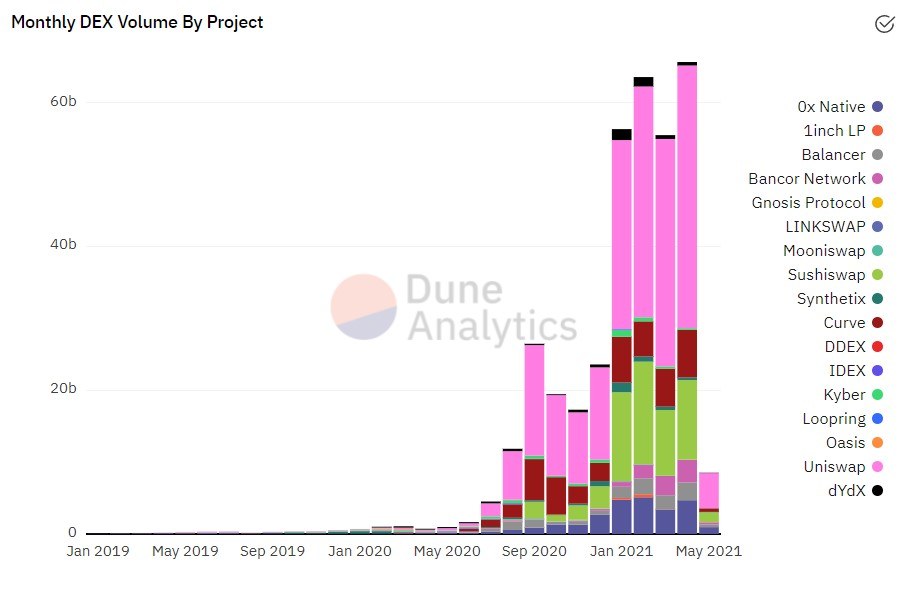

With the arrival of smart contracts, the altcoin leader’s landscape has evolved, giving rise to decentralized trades. DEXes haven’t just grown from the bubble but are becoming an important theme in today’s bull run.

The yearly volume of their very well-known DEXes from the cryptocurrency marketplace in April was well over $60 billion, representing a 5,900% year-over-year increase.

DEX volume graph

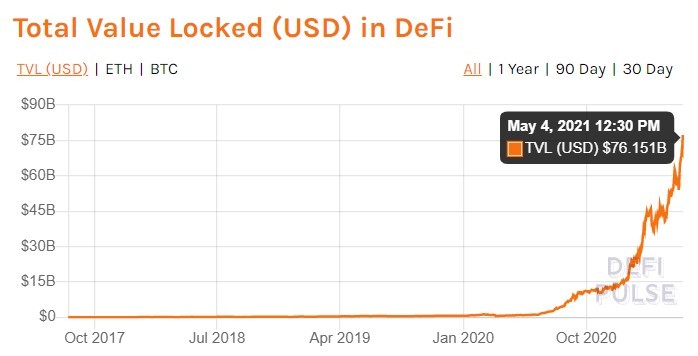

With Ethereum in its helm, DeFi has witnessed enormous growth as the entire value closed currently sits at $76 billion, an 83% growth over the last year.

The DeFi mania tracks back to April 2020, when Compound launched yield farming, that was a step farther than financing. In volatility farming, consumers deposited their holdings and obtained return in the type of the system’s native token, which may then be traded.

This invention allowed many jobs to spring up resulting in a huge explosion in funds inflow and grabbed associations’ interest. Grayscale Investment Co. An investment fund which caters mostly to high-net-worth investors and institutional customers, recorded a flurry of DeFi Coins in spite of need.

Finally, Multicoin Capital, a favorite cryptocurrency investment firm, declared the launching of 100″Venture Fund II,” that enables investors to give funds to different jobs in DeFi, Web3, NFTs, and much more.

Total value closed in DeFi graph

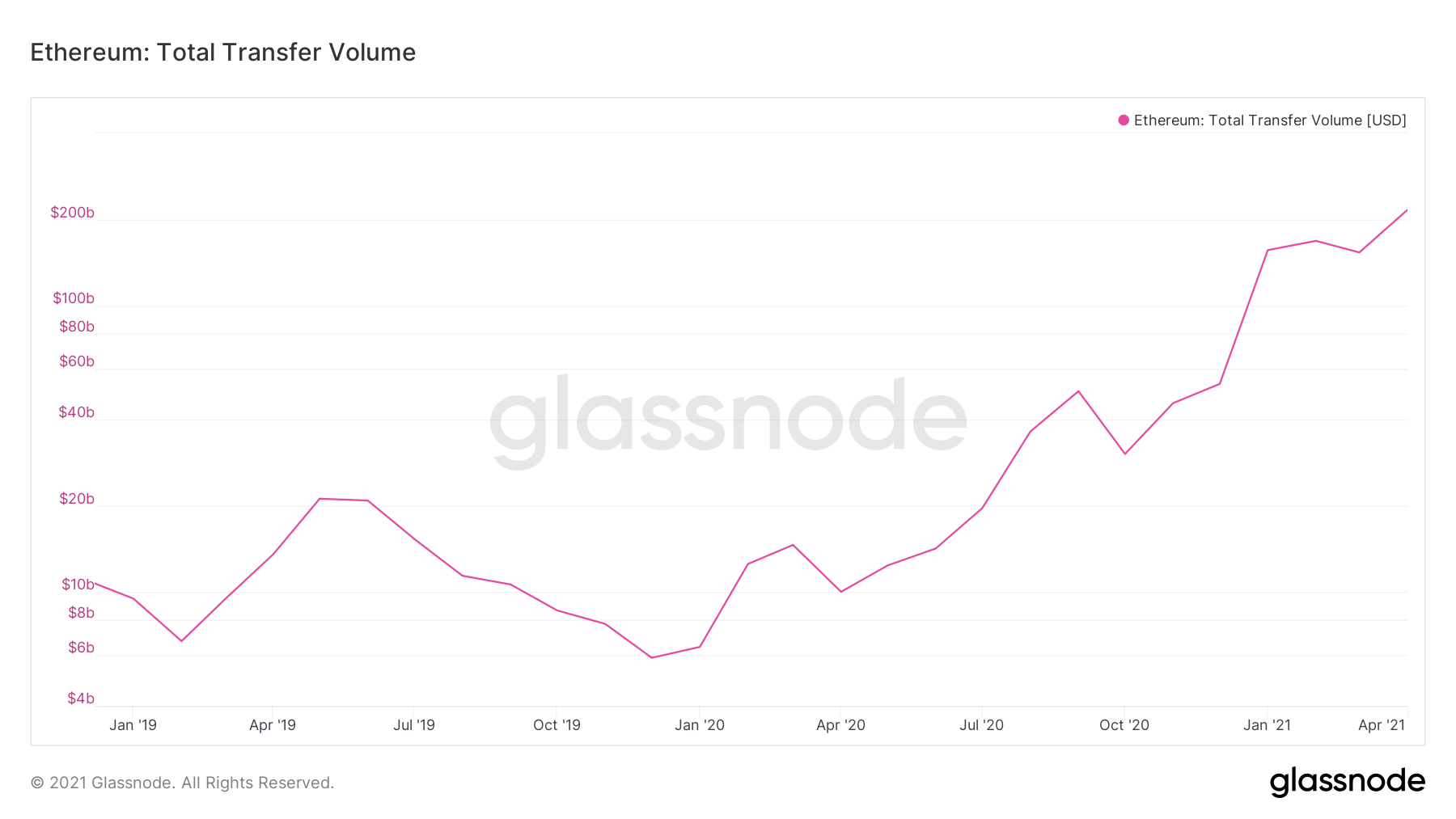

Within a summary of Ethereum, the whole amount settled from the wise contracts stage in April 2021 stands at $216 billion. ) But PayPal, a centralized payment processing giant, reported about 2.76 times less monthly trade volume.

Suffice to sayEthereum and its components like DeFi are beginning to compete with all the participants in centralized fund.

Ethereum total transport volume graph

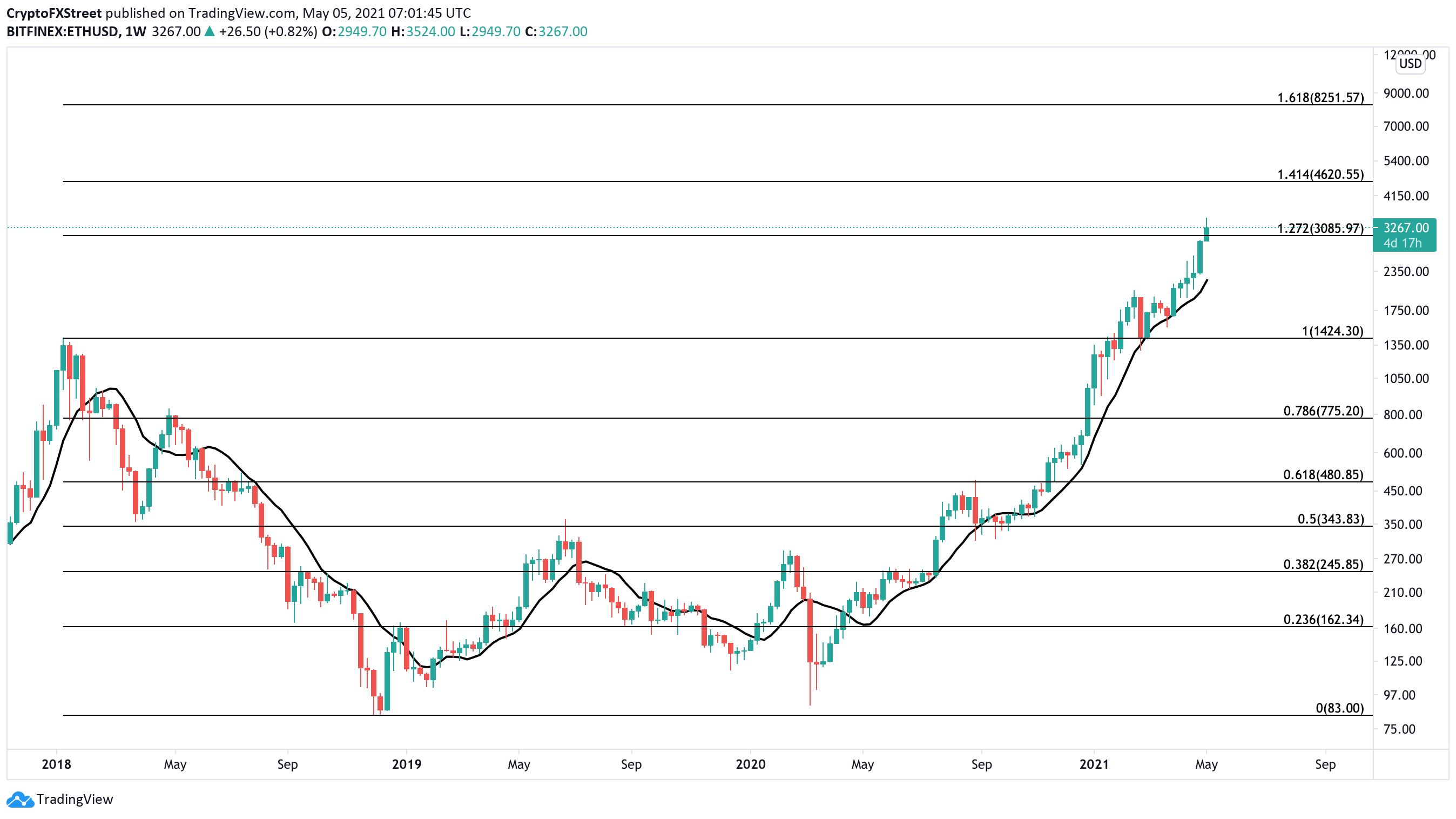

Ethereum cost pauses because it sets up a brand new all-time large at $3,524. With principles and adoption rising rapidly, it could be an understatement to state that ETH cost is expected for another leg up.

The current marketplace crashes seen in April have induced most dealers to take a step back. Therefore, the rally which pushed Ethereum to document levels has been seen with comparatively lower volumes and a decreased financing rate.

From a technical standpoint, a critical close over the new all-time large accompanied with a significant volume spike could spark an upswing into the 141.4percent Fibonacci expansion degree at $4,620.55.

ETH/USD 1-week graph

While the bullish story endorsed by principles is plausible, investors should be careful of a correction because of 2 reasons. Because this rally had reduced quantity financing, a sudden spike in selling stress could ruin the profits accumulated over the last week.

The first line of defense will be the 10-week Simple Moving Average (SMA) at $2,203. Interestingly, this index has affirmed Ethereum cost rally because mid-October 2020. Therefore a 32% fall to retest of the level isn’t outside the realm of possibility.

Under dire conditions, in the event the above mentioned level fails to soften the selling pressure, a 35% wreck will drive ETH to reevaluate the service barrier at $1,424.30.