If you have a long-term time investment horizon and Nike stock is on your radar as a potential buy, this is the time to “just do it,” say Wall Street analysts.

They’re probably right, given Nike’s

NKE,

+1.30%

ability to connect with consumers and its geographic reach into high-growth areas including China and other emerging markets. I’ve also recommended Nike in my stock letter Brush Up on Stocks for these reasons:

Key dynamics

The largest athletic footwear brand in the world, Nike is the category killer in running shoes and basketball kicks. Thanks to design prowess and sponsorships, Nike crushes the competition with popular shoes including Jordan, Air Max, Air Force 1 and Converse, a perennial favorite. Nike’s $37.4 billion in 2020 revenue was 35% greater than that of its closest competitor, Adidas AG

ADDYY,

+1.53%.

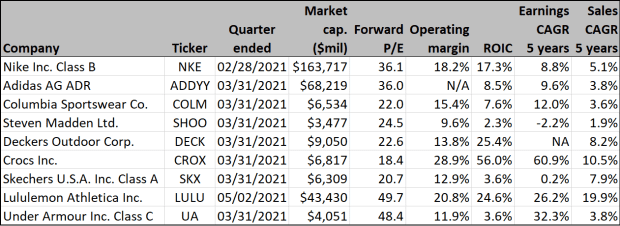

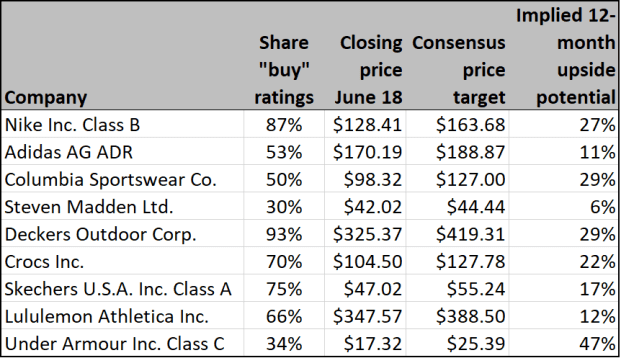

Nike ships about 800 million pairs of shoes per year. It also sells sports apparel and equipment. Footwear and fashion are tough categories because consumers are fickle. But Nike’s track record and profitability metrics demonstrate that the company has the skills to hold its market share and pricing power. Here’s how Nike stacks up against competitors and similar apparel retailers:

Profitability, size and growth metrics

FactSet

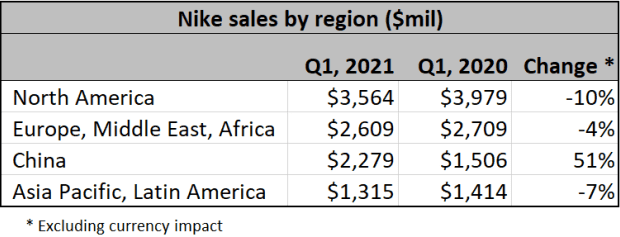

First-quarter sales growth of 3% doesn’t look great. North America revenues declined 10% and Europe was weak, too. But don’t get too hung up on this. This happened because of one-off problems: global container shortages and U.S. port congestion, and COVID-19 lockdowns. Nike projects 75% revenue growth in the second quarter as it laps a weak second-quarter of 2020.

Moreover, Nike is a reopening play that benefits from the desire of people to look good and exercise again as they emerge from lockdown. “Nike’s brand momentum is as strong as ever,” says the company’s CFO, Matt Friend.

Besides continually inventing popular shoes, Nike is carrying out a few tactical maneuvers to boost profits. It’s going directly to consumer via digital sales, as it trims the number of retail partners down to more prestigious names. This increases margins as it cuts out wholesalers and retailers, points out Jefferies analyst Randal Konik, who has a buy rating and a $192 price target on the stock. Long term, Nike wants to run half its sales through digital channels.

Geographic reach

Nike gets around 60% of its revenue outside the U.S. As of the summer of 2020, it had 758 stores overseas and 338 in the U.S. This gives investors exposure to higher-growth foreign economies, where discretionary consumer sales benefit from an emerging middle-class trend. Sales in China grew 51% in the first quarter, for example. “China is a massive growth opportunity,” Konik says.

FactSet

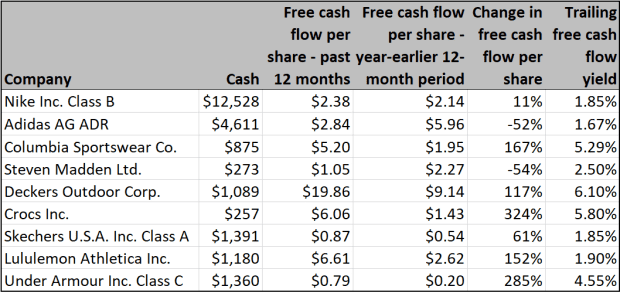

Cash and cash flow

Having a lot of cash and cash flow helps companies control their own destinies because they don’t need to rely on banks to fund growth. Nike has an edge here.

FactSet

Moat

Famed investor Warren Buffett loves companies with protective moats. They create pricing power and make it hard for competitors to win market share. Nike’s brand power puts a wide moat around its business, notes Morningstar analyst David Swartz. “Nike has been the preferred sportswear brand in the world since the 1980s and that it will remain so for many years,” he says.

Nike gets its brand power from two other sources. The company sponsors many of the world’s most popular athletes, including LeBron James, Kevin Durant and Michael Jordan in basketball, baseball stars Mike Trout and Giancarlo Stanton, and tennis great Serena Williams.

Nike also employs a team of specialists in engineering, exercise, chemistry and design to deploy technology that differentiate its shoes with features such as pressurized air, and materials borrowed from the aerospace industry. Nike’s innovation allows it to maintain premium pricing. Shoes such as Nike Air Vapor Max sell for about $200.

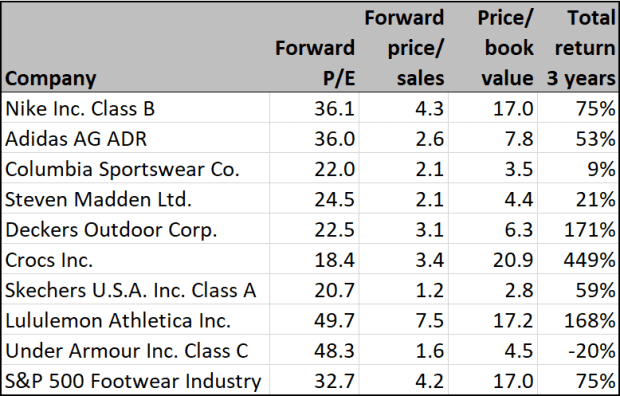

Stock valuation and performance

Here’s how Nike stock stacks up against competitors and the market using some common valuation metrics:

FactSet

Wall Street’s opinion

Here’s a summary of opinion among Wall Street analysts polled by FactSet:

FactSet

Risks

A strong U.S. dollar would hurt Nike because the company generates so much of its earnings abroad. Also, consumers can be fickle and you never know when they will latch on to new trends. Nike’s margins might be pressured if commodity prices remain high or wages increase. Trade wars, tariffs and increased U.S. -China tensions also would hurt Nike.

Important dates

- June 24 — Nike reports second-quarter earnings after the close.

- Sept. 20 — Nike reports third-quarter earnings.

Michael Brush is a columnist for MarketWatch. At the time of publication, he had no positions in any stocks mentioned in this column. Brush has suggested NKE, DECK and CROX in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks

Also read: Is the reflation trade over? What stock-market investors need to watch