The DeFi ecosystem is growing again, with its total value locked (TVL) just reaching a new all-time high at $51.78 billion yesterday, April 7th. The DeFi sector is larger than ever, with nearly a year-long steady growth. New projects are emerging all the time, and DeFi participants are in need of a top-quality, reliable place to exchange DeFi tokens.

Naturally, with the whole point of DeFi being decentralized, the only exchanges that can fit the bill need to be decentralized also, which is where Unidex comes in.

What is Unidex?

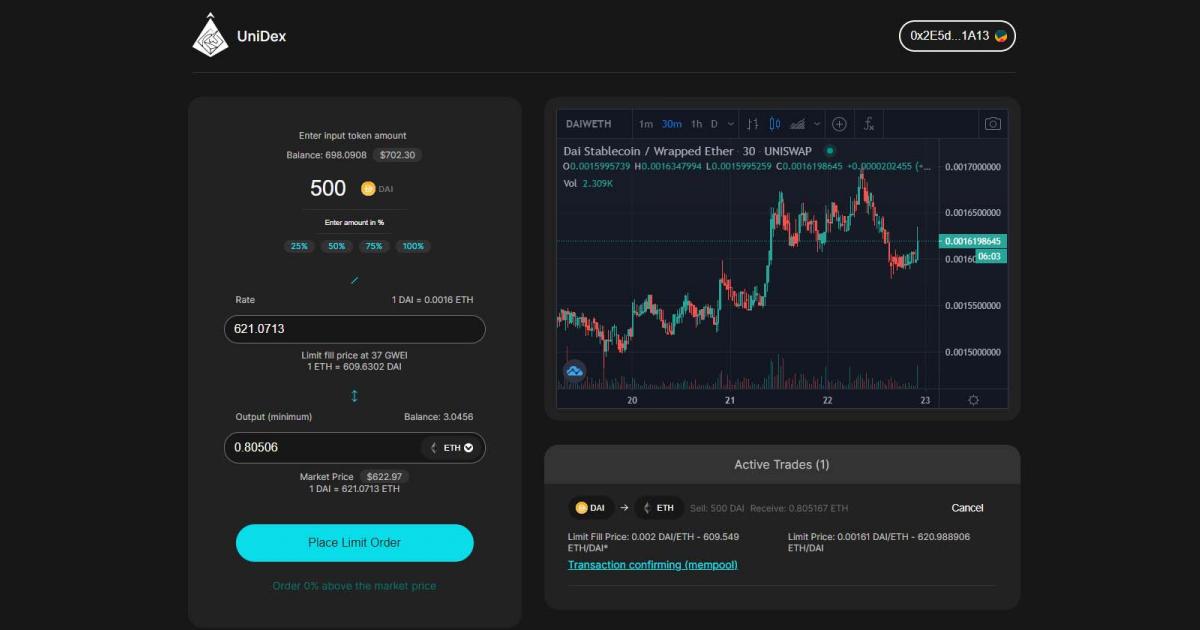

Unidex is a fully decentralized trading platform with a focus on DeFi protocols. It aims to be the go-to exchange for the entire DeFi ecosystem, and its developers created it in a way that would make it a great fit for beginners and experts alike. The exchange has a unique ability to use the best possible liquidity pools from any other DEX.

From this single exchange, users can find the best prices and the lowest slippage on the market.

Unidex aims to replace centralized exchanges (CEXes) by doing to them what they did to the banks — provide the same services, but in a better way. In this case, that means offering a fully decentralized platform for crypto trading. The platform was created with a few basic requirements that developers needed to meet, such as offering advanced services while still preserving the anonymity of users, as well as offering the highest quality trading experience.

Of course, this is not the first DEX out there. There have been many over the years, but most of those that emerged so far have failed due to the fact that they could not find a proper solution for providing good enough liquidity. Some platforms have figured out a way around this problem, and Unidex’s solution is by far the most advanced. It allows traders to trade across various other decentralized exchanges simultaneously.

So, by trading on Unidex, users get to reach many other advanced platforms and trade at their best prices, including platforms such as Uniswap, Balancer, Curve Finance, Kyber Network, 1inch Exchange, and others. The platform allows traders to reach not only these other exchanges’ liquidity pools, but also many other LPs.

What Does the Platform have to Offer?

So far, the exchange became a go-to place for NFTs, stocks, perpetuals, derivatives, options, swaps, lending, and more. There are hundreds of liquidity sources in total, multiple aggregators, and even cross-chain trading.

There is over $40 billion in instantly accessible liquidity, coming from chains, DEXes, and even CEXes. The platform also achieved more than 200 DeFi integrations, which is one of the best indicators of its rapid growth.

It is also rich when it comes to tools and features regarding data analytics, and more of new features are being added all the time. All of this is possible due to the fact that the exchange uses the Mirai Liquidity Engine, which aggregates any financial activities. It doesn’t compete with other aggregators, but instead, it aggregates all existing protocols and aggregators to ensure that traders would get the best returns.

Furthermore, it also gathers trading fees, and distributes 50% of what it collects to its token holders. This takes place every day, through an automatic system. In other words, there is no need for staking systems and vaults which often complicate things. All that users need to do is hold the token, and rewards will keep coming their way through airdrops. Since the project is multi-chain — supporting nearly 70 platforms at the time of writing — there is a variety of tokens that can be received as rewards.

The exchange is also working on reducing gas costs. Two days ago, on April 6th, it announced that it is pushing a small update that would reduce gas fees by another 4-6%, allowing users to save up more money for future trades and investments. Another area that it wishes to improve is the user interface (UI). The team is working on the full revamp of the UI in order to make it look and feel as best as possible.

Their focus is especially on aggregation, as the project even aggregates other aggregators, such as 1inch, 0x, paraswap, and many others. In the end, the goal is to always provide the best route/rate on the market, no matter what. So far, this has, in fact, been the case.

Medium | Telegram | Discord | Twitter

Media details

Company: Unidex

Email: support@unidex.exchange

Website: https://unidex.exchange/

(C) 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.