- DXY looks to extend Tuesday’s rebound from the 92.00 area.

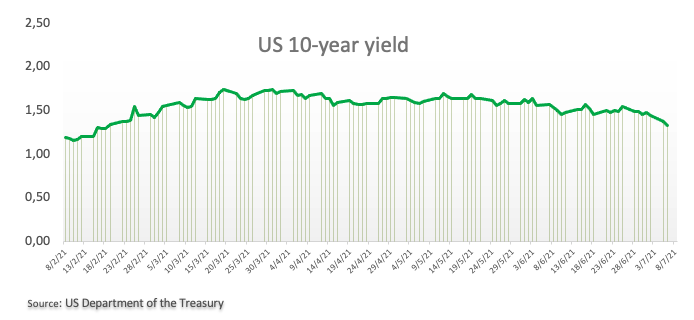

- Solid demand for 10-year bonds saw yields easing to multi-month lows.

- The FOMC Minutes will be the salient event later on Wednesday.

The greenback remains bid in the upper end of the weekly range around the 92.50 area when tracked by the US Dollar Index (DXY).

The index sticks to the positive ground for the second session in a row and manages to extend the rebound from the 92.00 neighbourhood recorded on Tuesday.

The ongoing increase in coronavirus cases of the Delta variant plus the likelihood that some countries might reinstate some lockdown restrictions lent legs to US bonds and forced yields of the key US 10-year benchmark to retreat to levels last seen back in February near 1.30%.

By the same token, the dollar posted strong gains and re-opened the door to a potential visit to recent highs in the 92.70/75 band.

Later in the session, all the attention will be on the FOMC Minutes. Additional data will see weekly Mortgage Applications by MBA, JOLT Job Openings and the weekly report on US crude oil supplies by the API.

The recovery in DXY seems healthy and points to a probable move to the recent peaks near 92.70. While the latest Payrolls figures might have disappointed USD-bulls somewhat, they remain solid and are indicative of the persistent improvement in the labour market. The investors’ shift in the sentiment around the dollar seems justified by the pick-up in risk aversion on the back of fresh concerns around the Delta variant of the coronavirus, strong fundamentals, high inflation and tapering prospects, particularly after the latest FOMC event.

Key events in the US this week: MBA Mortgage Applications, FOMC Minutes (Wednesday) – Initial Claims, Consumer Credit Change (Thursday).

Eminent issues on the back boiler: Biden’s multi-billion plan to support infrastructure and families. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating?

Now, the index is losing 0.02% at 92.52 and faces the next support at 91.51 (weekly low Jun.23) followed by 91.41 (200-day SMA) and finally 89.53 (monthly low May 25). On the upside, a breakout of 92.69 (weekly high Jul.1) would open the door to 93.00 (round level) and finally 93.43 (2021 high Mar.21).