- DXY clinches 3-day highs near 92.70 post-US data.

- US 10-year yields climb to the vicinity of 1.40% after CPI.

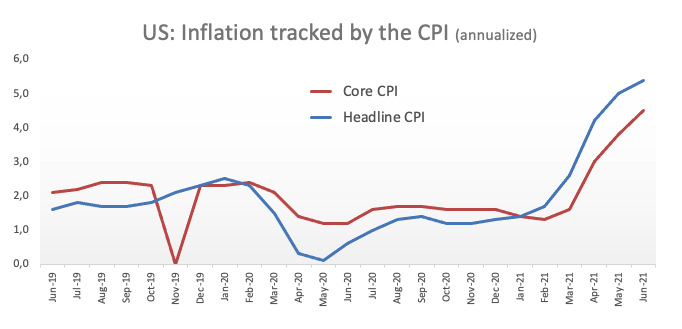

- US headline CPI, Core CPI surprised to the upside in June.

The dollar gathers extra upside traction and reaches new multi-day highs near 92.70 when gauged by the US Dollar Index (DXY).

The index exacerbated the upside to new 3-day peaks in the 92.70/75 band after US inflation figures measured by the CPI came in well above forecasts for the month of June.

Indeed, consumer prices rose at an annualized 5.4% and 4.5% when comes to prices excluding food and energy costs. Other data in the calendar noted the NFIB Index improved to 102.5 for the month of June (from 99.6).

Following the release of the inflation data, yields of the key US 10-year note briefly tested the vicinity of 1.40%, while Fed Funds Futures now price in a 90% probability of a rate hike by end of 2022 and 100% in January 2023.

The recovery in DXY clinched new tops near 92.90 before easing to the vicinity of the 92.00 neighbourhood at the end of last week. The latest FOMC Minutes did show early tapering discussions, a positive assessment of the pace of the US recovery and hints that high inflation could last longer than initially estimated, all of this underpinning the improved sentiment around the buck. However, the latest Payrolls results kind of supported the patient stance from the Federal Reserve and carry the potential to temper a more serious upside in the dollar.

Key events in the US this week: Powell’s Semiannual testimony, Fed’s Beige Book (Wednesday) – Initial Claims, Powell’s Semiannual testimony, Philly Fed Index, Industrial Production (Thursday) – Retail Sales, advanced July Consumer Sentiment (Friday).

Eminent issues on the back boiler: Biden’s multi-billion plan to support infrastructure and families. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating?

Now, the index is gaining 0.41% at 92.60 a breakout of 92.84 (monthly high Jul.7) would open the door to 93.00 (round level) and finally 93.43 (2021 high Mar.21). On the other hand, the next support emerges at 91.51 (weekly low Jun.23) followed by 91.38 (200-day SMA) and finally 89.53 (monthly low May 25).