- USD/CAD is likely to break its bearish consolidation to the downside.

- The relentless rise in WTI prices offset the US dollar’s advance.

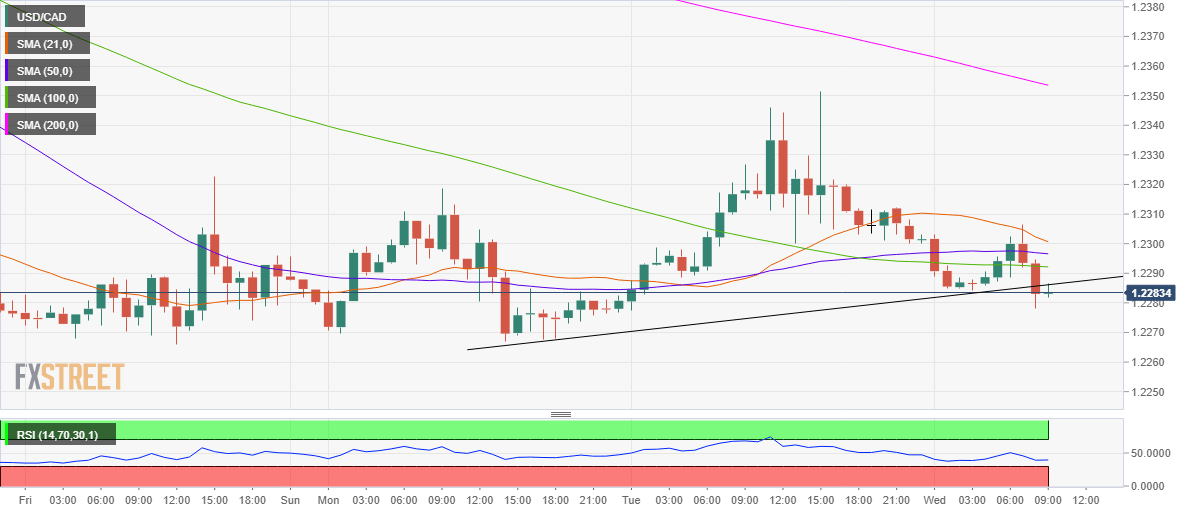

- The hourly chart shows a breach of the ascending trendline support.

USD/CAD is looking to challenge the April low of 1.2265, as the risks remain to the downside amid a rally in WTI prices.

The US oil sits at two-month highs of $66.63, as the sentiment has turned bullish on expectations of a faster vaccine-driven global economic recovery, which is likely to boost the fuel demand.

Meanwhile, the relentless surge in oil prices appears to negate the effect of a broadly firmer US dollar, exerting persistent downward pressure on the spot.

Next of note for the major remains the US ADP and ISM Services PMI reports. In the meantime, the oil price dynamics will continue to play out.

USD/CAD: Hourly chart

USD/CAD’s hourly chart shows that the price is attempting a minor bounce after having breached the two-day ascending trendline support at 1.2285.

The Relative Strength Index (RSI) has turned flat but trades at 38.58, implying that deeper losses remain on the cards.

Therefore, the April month low remains at risk, below which the psychological 1.2250 level will come into the picture.

Note that the spot is trading below all the major averages on the given time frame.

Alternatively, buyers need to scale back above the trendline support now resistance at 1.2286 to extend the recovery momentum towards 1.2300.