After a two-day rise, the USD/INR retests its intraday low, and bears reclaim control.

The US currency falls amid hopes that Fed Chairman Powell will defend cheap money, while S&P maintains India’s BBB- grade.

DXY is weighed down by US Treasury yields, while covid fears remain high.

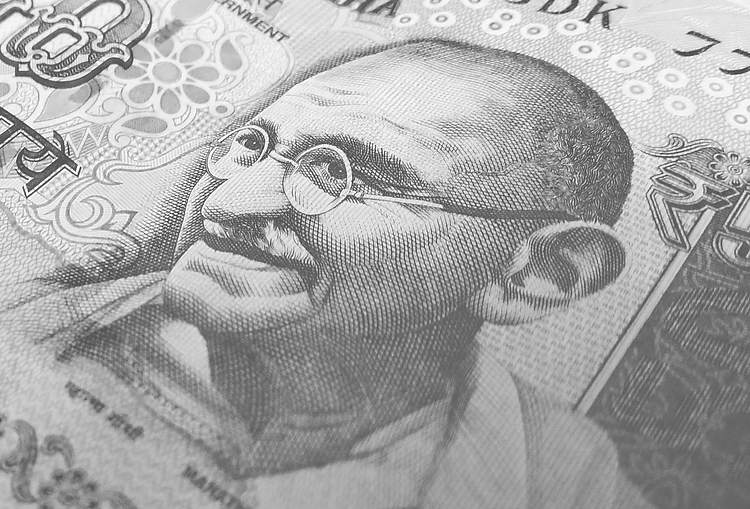

During the first Indian trading day on Wednesday, the USD/INR trades around 74.52, down 0.16 percent intraday. On mixed signs, the Indian rupee (INR) pair retested the weekly high on Tuesday before halting the two-day run-up.

With the latest addition of 38,792 infections, India’s daily covid positive rate has remained below 3.0% for the past 23 days. This indicates that the Asian nation will be able to keep the epidemic chained after the two waves, which will benefit the INR.

The global rating agency S&P’s unchanged rating outlook for India, citing the country’s strong external conditions, might also be a plus. The USD/INR prices are also weighed down by the US dollar’s retreat from the monthly high, as well as the first daily negative performance of US Treasury yields.

It should be emphasized, however, that the robust US Consumer Price Index (CPI) data released the day before supports Fed tapering fears while suggesting safe-haven dollar buying. Similarly, rising coronavirus (COVID-19) outbreaks in Asia and the West add to the greenback’s risk-averse demand.

US stock futures and Treasury yields continue under pressure amid these maneuvers, with all eyes on the covid updates for immediate direction.

The key will be Fed Chairman Jerome Powell’s testimony before the House Financial Services Committee on the Semi-Annual Monetary Policy Report. Despite the fact that Fed Chairman Powell is expected to reiterate the “transitory” prognosis for price pressures, any surprises will be treated seriously given the varied contents of the CPI.

Powell’s Predictions: Three reasons to expect the Fed Chair to lower the dollar The MACD has turned bearish for the first time since June 1, but a 13-day-old support line near 74.40 should limit USD/INR losses in the immediate term. Bulls are still aiming for the 75.00 level unless they can break through the 74.35 support confluence, which includes the 21-day moving average and a three-week-old rising trend line./n