USD/INR extends its fall from the weekly high and makes a late intraday low.

Despite high infections and mortality tolls elsewhere in Asia-Pacific, India’s covid recovery rate has risen to 97.19 percent.

India’s growth estimate has been lowered by Fitch, and negotiations on a free trade agreement between India and the United Kingdom will begin in late 2021.

The risk-averse mindset returns. The key to the US dollar in a light calendar is malware updates.

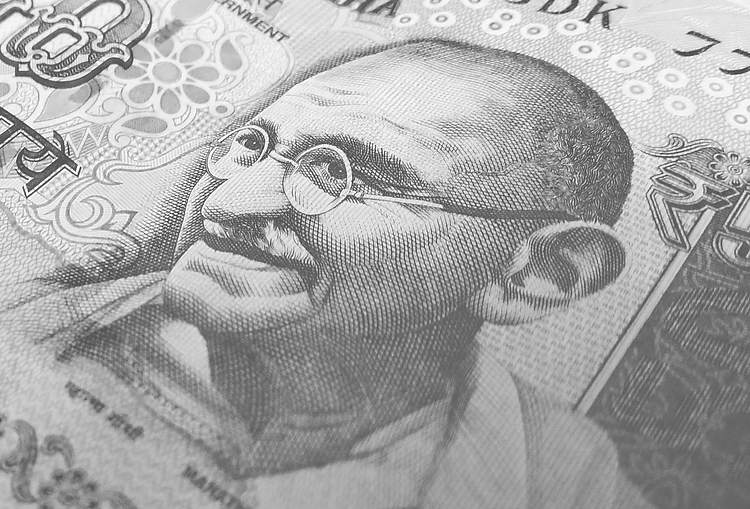

During the first Indian session trading on Friday, the USD/INR trades around 74.63, down 0.15 percent intraday. As a result of the coronavirus (COVID-19)-driven risk-off sentiment, the Indian rupee (INR) pair falls for the second day in a row after refreshing the weekly high.

While market mood remains slow due to concerns over the covid comeback and variations, India’s recovery rate increased to 97.19 percent on Friday, according to the latest report from the Ministry of Health. “India announces 44,459 daily spike in recoveries; overall recoveries at 29.89 million, active cases at 458,727,” according to Reuters.

Read more: Coronavirus Update: South Korea Sets New Highs in Infections, NSW Suggests Week-Long Lockdown

The headlines expressing optimism about the India-UK free trade deal talks may also be benefiting the USD/INR values. According to the most recent update from NewsRise, which was published by Reuters, the much-anticipated trade discussions will be discussed in late 2021.

On the negative side, according to Financial Express, Fitch cut India’s growth forecast for the current fiscal year to 10% from 12.8 percent earlier, citing a slowing recovery following the second wave of COVID-19, and stating that rapid vaccination could support a long-term recovery in business and consumer confidence.

In the midst of these maneuvers, the US dollar index (DXY) gains up bids as US Treasury yields rise.

Looking ahead, USD/INR traders should keep a careful eye on the covid headlines, as the country’s surprise positive on the covid, despite the fact that the bulk of its neighbors are suffering, could quickly derail, offering a downside risk to the pair.

While the mid-April lows highlight 74.55 as the main immediate support, the USD/INR sellers are also challenged at 74.48 by an ascending support line dating back to May 31. Up-moves can keep an eye on the 75.00 level in the meanwhile./n