USD/INR pulls down from the 10-day moving average, with sellers aiming for a three-week-old support line.

Bearish MACD indications favor targets in mid-May, with a late-June bottom providing an extra quick filter to the south.

Beyond close support, the Bulls maintain 75.00 on their radar.

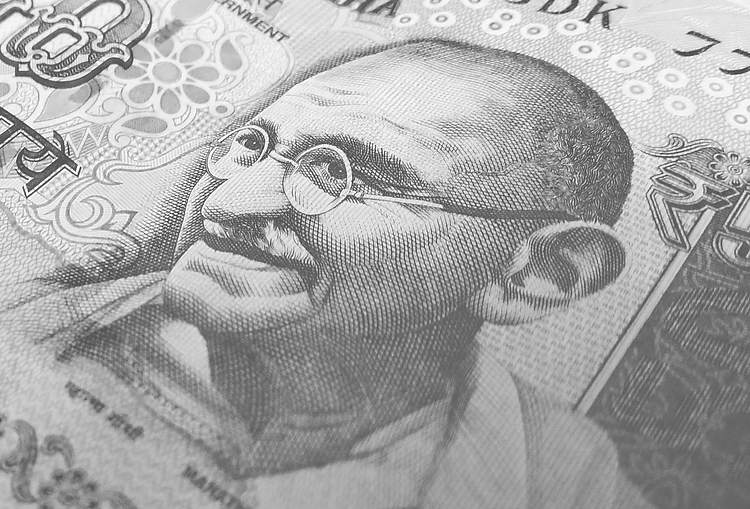

In the early hours of Friday, the USD/INR fades bounce off short-term support, easing off the 10-DMA. The Indian rupee (INR) pair falls to 74.53 as a result, as traders look for new direction.

However, the pair’s ability to cross the immediate moving average and steadily firming the bearish bias of MACD keeps the pair sellers hopeful. A daily close below the nearby support line, around 74.45, is required, however.

Following that, the 74.00 round figure, which is approaching late June lows, may entice short-term USD/INR sellers before directing them to the May 14 high near 73.70.

Although a drop below 73.70 is becoming less plausible, sustained weakening will not hesitate to challenge horizontal support near 73.30, which was established in early May.

Meanwhile, a break above the 10-DMA level of 74.58 will put the monthly peak near 74.90 in jeopardy. USD/INR bulls, on the other hand, will remain unconvinced as long as the rate remains below the 75.00 level.

Bulls in the USD/INR appear to have run out of steam, and a violation of the trend line could cause a new downturn.

Pullback is projected as a trend./n

Read More