- USD/JPY attracted some dip-buying near the 109.00 mark and moved back closer to session tops.

- Sustained move beyond mid-109.00s would set the stage for some near-term appreciating move.

- Break below the 109.00 mark will negate the constructive outlook and prompt aggressive selling.

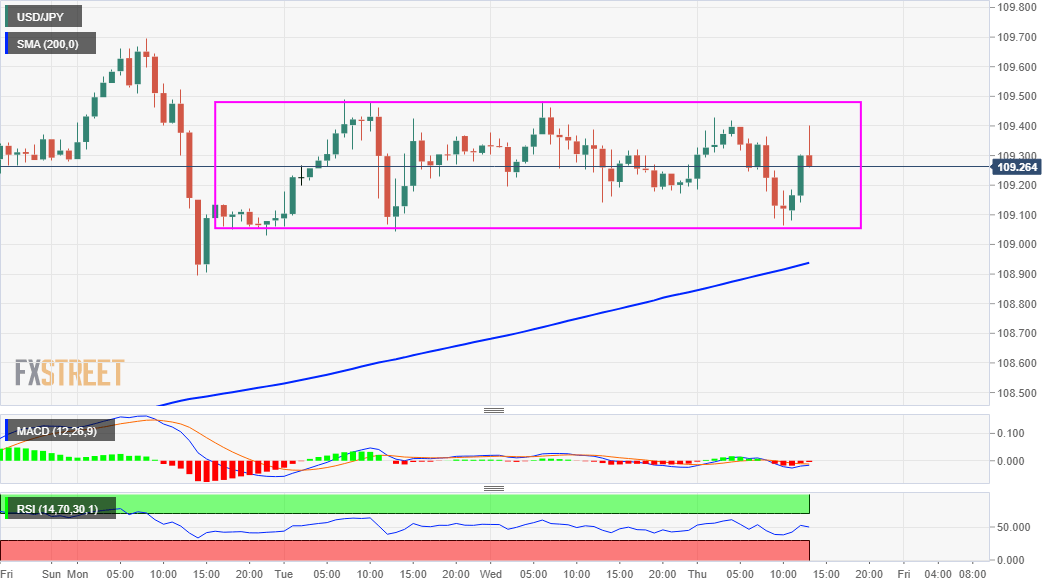

The USD/JPY pair reversed an intraday dip to the 109.00 area and climbed to the top end of its intraday trading range during the early North American session. The pair was last seen hovering just below mid-109.00s, up around 0.15% for the day.

The underlying bullish sentiment in the financial markets continued undermining demand for the safe-haven Japanese yen and extended some support to the USD/JPY pair. That said, the prevalent US dollar selling bias might keep a lid on any meaningful gains for the major.

Looking at the technical picture, the 109.45-50 region has been capping the upside since Tuesday and should act as a pivotal point for short-term traders. Some follow-through buying has the potential to push the USD/JPY pair beyond weekly swing highs, around the 109.70 region.

Bulls might then aim back to reclaim the key 110.00 psychological mark before lifting the USD/JPY pair further towards the 110.55-60 resistance zone. The constructive outlook is reinforced by the fact that oscillators on the daily chart have just started gaining positive traction.

Hence, a subsequent strength towards the 110.55-60 resistance zone, en-route the 111.00 neighbourhood, or one-year tops touched in March, remains a distinct possibility.

On the flip side, the 109.00 round-figure mark now seems to have emerged as immediate strong support. Sustained weakness below might prompt some technical selling and accelerate the fall to the 108.65-60 support before the USD/JPY pair eventually drops to the 108.00 mark.