- USD/TRY trades on the defensive near 8.7300.

- The lira regains some composure following recent record lows.

- Turkey is forecast to have expanded around 20% in Q2.

The Turkish lira manages to regain some composure and now drags USD/TRY to the 8.7300 region on Monday.

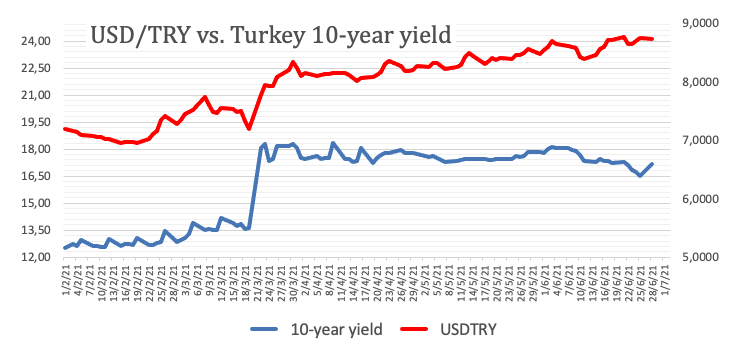

After clinching new all-time highs in the 8.800 zone last week, USD/TRY now gives away part of that advance and briefly tested the 8.7100 zone, where some support seems to have turned up.

In fact, the lira manages to regain some ground lost despite the broad-based upbeat tone in the dollar at the beginning of the week.

The lira’s better mood follows the uptick in yields of the Turkish 10-year note, which regain the 17% hurdle and leaves behind some of the recent weakness.

On another front, Turkish finmin L.Elvan said on Friday that he expects the domestic economy to have expanded by around 20% in Q2, crushing the government’s forecasts for a nearly 6% expansion in the same period. Elvan justified the strong prediction exclusively on base effects.

The outlook for the Turkish lira remains fragile despite the steady hand from the Turkish central bank (CBRT) at its recent meetings. Despite inflation appears to have peaked in April, it still remains (very) high and a move on rates in the short-term horizon seems to have lost some motivation for the time being. In the meantime, political effervescence within the ruling AK Party, the impact of the pandemic on the economic outlook, high unemployment and the so far utter absence of any intentions to implement the much-needed structural reforms remain poised to keep the lira under perseverant pressure for the foreseeable future.

Key events in Turkey this week: June Economic Confidence (Tuesday) – Trade Balance (Wednesday) – Manufacturing PMI (Thursday).

Eminent issues on the back boiler: Potential US/EU sanctions against Ankara. Government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Capital controls? The IMF could step in to bring in financial assistance.

So far, the pair is losing 0.44% at 8.7123 and a drop below 8.5953 (weekly low Jun.23) would aim 8.4439 (50-day SMA) and finally 8.2803 (monthly low Jun.11). On the upside, the next resistance is located at 8.7974 (all-time high Jun.25) ahead of 9.0000 (round level).