Let’s face it, April’s U.S. jobs report was a head scratcher by most accounts. The 266,000 extra payrolls represent the biggest missed forecast for economists’ predictions for nonfarm payrolls since the 1990s, with many forecasting that 1 million people were added to payrolls last month.

The labor market data doesn’t necessarily derail upbeat expectations for the employment outlook though. Jefferies Aneta Markowska and Thomas Simons, who had forecast that the April jobs figures would top 2 million, said they remain bullish on employment but described Friday’s miss as simply “ hard to explain,” in a report after the Labor Department data.

However, nonfarm payrolls data do provide a good opportunity for investors to think about how the global economic recovery might take shape, as the world attempts the hardscrabble rebound from the coronavirus pandemic.

A possibly unsteady recovery for the U.S. underscores the utility of diversification in investors’ portfolios.

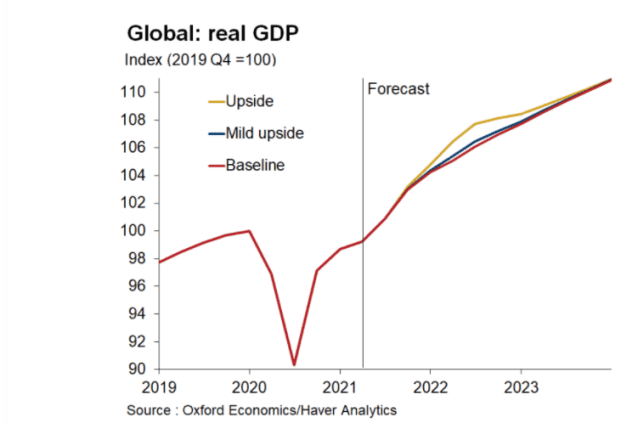

A Friday report from Oxford Economics says pent-up demand is seen building in the global economy as vaccines and COVID lockdowns ease, even as parts of the world, notably India, show a rise in cases.

“Despite Covid cases rising globally, upside risks to our already relatively

optimistic baseline are material,” wrote Innes McFee, chief global economist at Oxford Economics.

“Our baseline estimates advanced economy consumers will spend on average 5% of these savings. But if they splash out even a little more, the 2022 growth outlook will rise considerably,” the analyst wrote.

“The main risk stems from the estimated $4.7 [trillion] pile of excess savings accumulated by consumers in advanced economies that could be tapped to unleash a wave of post pandemic spending,” the economist wrote.

Oxford Economics

Franziska Palmas, market economist at Capital Economics, predicts European markets will outperform in the U.S. in the second half of 2021, citing a resumption of appetite for value-oriented sectors, banks and energy, that tend to populate European bourses.

The economist also said that fears of a higher corporate-tax regime under President Joe Biden may also help to shift some interest away from U.S. markets.

“The upshot is that we forecast the MSCI [European Economic and Monetary Union] to rise by ~3% between now and end-21. This compares with a projected increase of less than 1% for the MSCI USA,” Palmas writes.

Analysts at Morgan Stanley say that investors can hope to find some growthy investment opportunities in Europe and shouldn’t just think of it as a bastion of old-world industries.

“European equities are shifting away from their ‘old economy’ exposure and offer a greater exposure to structural growth (e.g. Tech is now the biggest sector in theEuro STOXX 50),” wrote Morgan Stanley’s Matthew Garman, Graham Secker and Ross MacDonald, in research note dated May 5.

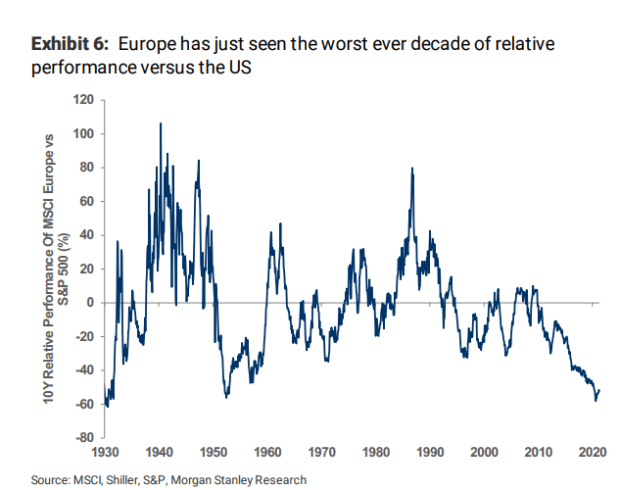

The big question is whether European stocks are ready to outperform the U.S. after a decade of underperformance.

Morgan Stanley notes that Europe markets have seen the worst-ever decade of performance relative to the U.S.

via Morgan Stanley

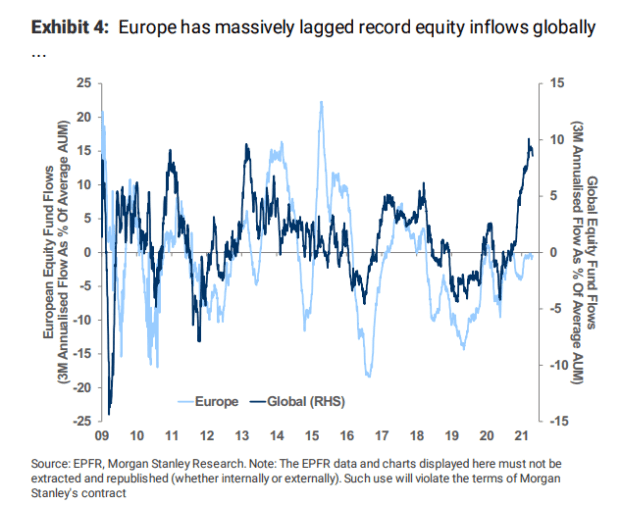

Europe also has been underloved in terms of investment flows into European stocks.

via Morgan Stanley

Indeed, Europe shows evidence of a strong rebound, with the Stoxx Europe 600 Index

SXXP,

+0.89%

booking a record on Friday, while the FTSE 100

UKX,

+0.76%

scored a new 52-week high leaving it about 9.5% from its last record close put in on May 22, 2018.

The Dow Jones Industrial Average

DJIA,

+0.66%

and the S&P 500 index

SPX,

+0.74%

posted record closes on Friday, as the weak jobs report affirmed views that the Federal Reserve will keep financial conditions easy for longer.

Many analysts looking at the U.S. remain confident in the scope for the economy to grow rapidly and for jobs growth to accelerate significantly in the months ahead, supported by trillions of dollars in fiscal stimulus.

Jeff Schulze, investment strategist at ClearBridge Investments, told MarketWatch’s Bill Watts that as Europe gets a handle on vaccine rollouts, its economy will also begin to spring back to life. That could put an end to a run of U.S. outperformance, he speculates.

The strategist also said that Japan is likely to follow suit, and the rest of Asia thereafter.