SOPA Images/LightRocket via Getty Images

[Updated: 5/26/2021] TTWO Stock Update

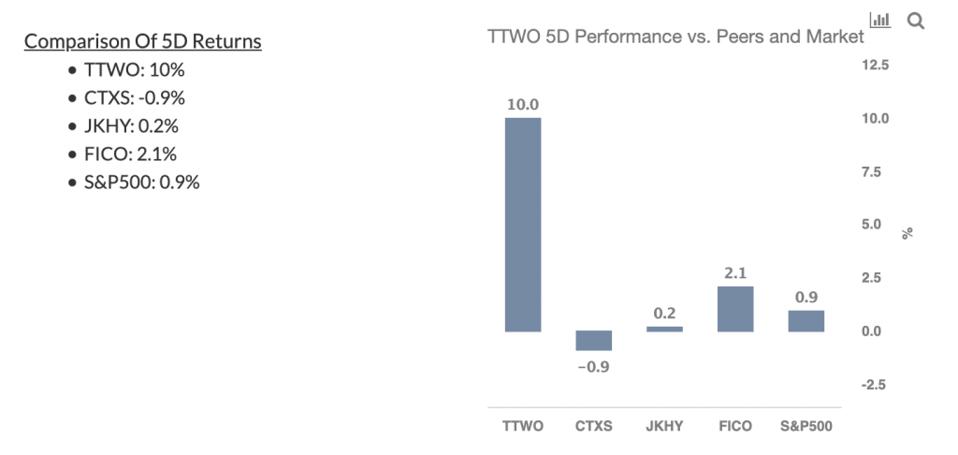

The stock price of Take-Two Interactive (NASDAQ: TTWO) has seen a 10% rise over the last five trading days, and we believe the stock will likely continue to rally in the near term. The 10% rise can primarily be attributed to the company’s recently announced fiscal Q4 numbers, which were above the street estimates. Take-Two Interactive’s fiscal Q4 bookings of $784 million (up 8% y-o-y) were well above the consensus estimate of $664 million. Similarly, its EPS of $1.40 per share was much higher than the $0.66 for the consensus estimate.

Looking at the recent rally, the 10% rise for TTWO stock over the last five days compares with a 0.9% growth seen in the broader S&P 500 index. Now, is TTWO stock poised to grow further or is a decline after the recent rise imminent? We believe the TTWO stock will continue to rally in the near term, given the strong momentum in the stock, a solid Q4 beat, and based on our machine learning analysis of trends in the stock price over the last few years.

Out of 67 instances in the last ten years that TTWO stock saw a five-day rise of 10% or more, 44 of them resulted in TTWO stock rising over the subsequent one month period (twenty-one trading days). This historical pattern reflects 44 out of 67, or about a 66% chance of gain in TTWO stock over the coming month. See our analysis on Take-Two Interactive Stock Chances of Rise for more details.

Five Days: TTWO 10%, vs. S&P500 0.9%; Outperformed market

(3% likelihood event)

- Take-Two Interactive Software stock rose 10.0% over a five-day trading period ending 5/24/2021, compared to a broader market (S&P500) rise of 0.9%

- A change of 10% or more over five trading days is a 3% likelihood event, which has occurred 69 times out of 2516 in the last ten years.

MORE FOR YOU

Ten Days: TTWO 9.5%, vs. S&P500 0.3%; Outperformed market

(7% likelihood event)

- Take-Two Interactive Software stock rose 9.5% over the last ten trading days (two weeks), compared to the broader market (S&P500) rise of 0.3%

- A change of 9.5% or more over ten trading days is a 7% likelihood event, which has occurred 178 times out of 2511 in the last ten years

Twenty-One Days: TTWO 5%, vs. S&P500 0.5%; Outperformed market

(39% likelihood event)

- Take-Two Interactive Software stock rose 5.0% the last twenty-one trading days (one month), compared to the broader market (S&P500) rise of 0.5%

- A change of 5% or more over twenty-one trading days is a 39% likelihood event, which has occurred 965 times out of 2500 in the last ten years.

[Updated: 4/12/2021] TTWO vs. ATVI

We think that Take-Two Interactive currently is a better pick compared to Activision Blizzard

ATVI

. TTWO stock trades at about 6x trailing revenues, compared to around 9x for Activision Blizzard. Does this gap in Take-Two’s valuation make sense? We don’t think so. While both the companies have benefited in the pandemic with an overall increase in gaming demand, and they are now focused on launch of remastered games for newer generation consoles, TTWO stock is being weighed down over concerns of slowing sales growth in the near future. However, there is more to the comparison. Let’s step back to look at the fuller picture of the relative valuation of the two companies by looking at historical revenue growth as well as operating income and operating margin growth. Our dashboard Activision Blizzard vs. Take-Two Interactive: ATVI stock looks overvalued compared to TTWO stock has more details on this. Parts of the analysis are summarized below.

1. Revenue Growth

Between 2017 and 2020, Activision Blizzard’s revenues grew by about 16%, from around $7.0 billion to $8.1 billion, primarily led by continued strong demand for the Call of Duty franchise, which garnered over $3 billion in total bookings in 2020. Looking at Take-Two, total revenue grew 72% from $1.8 billion in fiscal 2017 to $3.1 billion in fiscal 2020 (TTWO’s fiscal ends in March), led by strong growth for its top franchises – NBA 2K, Grand Theft Auto, and Red Dead Redemption. Looking at the last twelve month period, Take-Two’s revenues have further increased to $3.3 billion.

2. Operating Income

Activision Blizzard’s operating income grew over 2x from $1.3 billion in 2017 to $2.7 billion in 2020, led by revenue growth as well as expansion of operating margins from 18.4% to 33.4% over the same period. The margin expansion was primarily being driven by a significant reduction in product development expenses, which as a percentage of revenue has dropped from 20% in 2017 to 13% in 2020. Looking at Take-Two, the operating income surged 4.5x from $93 million in fiscal 2017 to $420 million in fiscal 2020, and it increased further to $490 million for the last twelve month period. Take-Two’s operating margins improved meaningfully from 5.2% in 2017 to 14.9% for the last twelve month period. The margin expansion for Take-Two is being driven by lower SG&A costs.

The Net of It All

Although Activision Blizzard’s operating margins compare favorably with Take-Two over the recent years, Take-Two’s operating margin expansion as well as revenue growth has comparatively been higher. Both the companies are benefiting from continued demand for their existing franchises. However, TTWO stock has been weighed down over investors concerns of slowing growth for Grand Theft Auto, which accounts for roughly a quarter of the company’s total sales. Going by consensus estimates, Take-Two’s total revenue is expected to grow 14% in fiscal 2021, but the growth rate is expected to drop to just 4% in fiscal 2022 (compared to 1% and 13% growth estimated for ATVI in 2021 and 2022, respectively). However, the company will launch a remastered version of Grand Theft Auto V for new generation consoles in fiscal 2022, which could bode well for the company’s overall sales growth. While both the companies have consistently improved their operating margins, Take-Two’s expansion has been higher, a trend expected to continue in the near term, bolstering its earnings growth. As such, we think the difference in P/S multiple of 9x for Activision Blizzard versus 6x for Take-Two will likely narrow going forward in favor of the less expensive TTWO stock.

While Take-Two stock looks undervalued, 2020 has also created many pricing discontinuities that can offer attractive trading opportunities. For example, you’ll be surprised how counter-intuitive the stock valuation is for Electronic Arts vs TeleTech.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams

/https://specials-images.forbesimg.com/imageserve/5f45f985d3d8e91ad6eb03ec/0x0.jpg)