Wednesday’s preliminary reading of the first-quarter (Q1) 2021 UK GDP numbers, up for publishing at 06:00 GMT, becomes the key for GBP/USD traders amid fears of losing economic momentum as well as the Bank of England’s (BOE) hawkish stint.

Market consensus suggests the Office for National Statistics (ONS) print downbeat QoQ figures of -1.6% versus +1.3% prior whereas the YoY data may have improved from -7.3% to -6.1%, per the forecasts.

In addition to the quarterly GDP, March’s monthly growth figures will accompany Trade Balance and Industrial Production details for the stated period to keep the GBP/USD traders busy ahead of the key US Consumer Price Index (CPI) figures.

Forecasts suggest that the UK GDP will rise to 1.4% MoM in March versus 0.4% previous readouts while the Index of Services (3M/3M) for the same period is seen recovered from -1.9% prior.

Meanwhile, Manufacturing Production, which makes up around 80% of total industrial production, is expected to ease from 1.3% MoM prior to 1.0% in March. Further, the total Industrial Production is expected to remain unchanged at 1.0% during the stated month.

Considering the yearly figures, the Industrial Production for March may have recovered from -3.5% to +2.3% while the Manufacturing Production is also anticipated to have risen by 3.7% in the reported month versus 4.2% contraction marked the last.

Separately, the UK Goods Trade Balance for March will be reported at the same time and is expected to show a deficit of around GBP15 billion versus a GBP10.728 billion deficit reported in February.

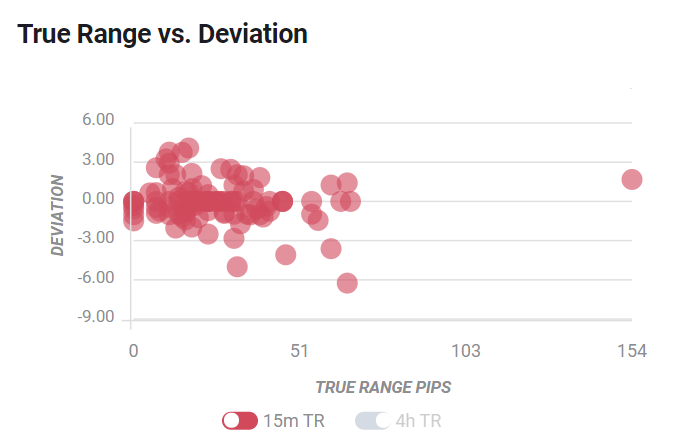

Readers can find FX Street’s proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 30-pips in deviations up to + or -3, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

GBP/USD bears the burden of risk-aversion while snapping a three-day winning streak, not to forget easing from the 11-week top marked the previous day, ahead of Wednesday’s London open. That said, the cautious sentiment ahead of the key UK Q1 GDP and the US CPI for April weigh on the cable, down 0.2% intraday near 1.4115, by the press time.

That said, an upside surprise of the UK GDP becomes necessary for the GBP/USD buyers to confirm a rounding bottom bullish formation and attack the yearly top surrounding 1.4200. Alternatively, downbeat data, as anticipated, may have another chance to recall the bulls should US CPI triggers risk-on mood by signaling no challenges to the Fed’s easy money policies, at least for now.

In this regard, FXStreet’s Yohay Elam says, “While the three previous publications have surprised to the upside, they have been minimal. Moreover, market participants have already learned that the impact of the new lockdowns was relatively moderate in comparison to that of the first shuttering. All this implies that the chance of an upside surprise is minimal.”

Technically, the upper line of the one-month-old rising trend channel around 1.4145 tests GBP/USD bears amid overbought RSI conditions, suggesting a pullback move towards the previous key resistance area around 1.4020-10 comprising multiple tops marked since early March.

UK GDP Preview: Contraction to trigger correction? Sterling set for a reality check

GBP/USD: Bulls catch a breather above 1.4100 ahead of UK GDP, US inflation

GBP/USD Forecast: Reopenings optimism supports the pound

The Gross Domestic Product (GDP), released by the Office for National Statistics (ONS), is a measure of the total value of all goods and services produced by the UK. The GDP is considered as a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).