As AMC Entertainment Holdings Inc (NYSE: AMC) shares tumbled nearly 18% in Thursday’s regular session, retail investors on r/WallStreetBets set their sights on yet another stonk — Blackberry Ltd (NYSE: BB).

What Happened: Blackberry attracted the most mentions on the Reddit forum known best for short squeezes in several names like GameStop Corporation (NYSE: GME), AMC, and others — for the second day in a row.

Over a 24-hour period, Blackberry received 13,229 mentions, while AMC and GameStop attracted 9,109 and 2,017 mentions, respectively, as per Quiver Quantitative data.

Reddit poster u/3picEmuBoy wrote, “BlackBerry is only beginning its journey, and the fundamentals back this up.” The poster cited developments like QNX Software of the company, which is under testing by automakers like Volvo, BlackBerry’s scalable cloud-connect software IVY, and an upcoming 5G phone as factors that work in favor of the company.

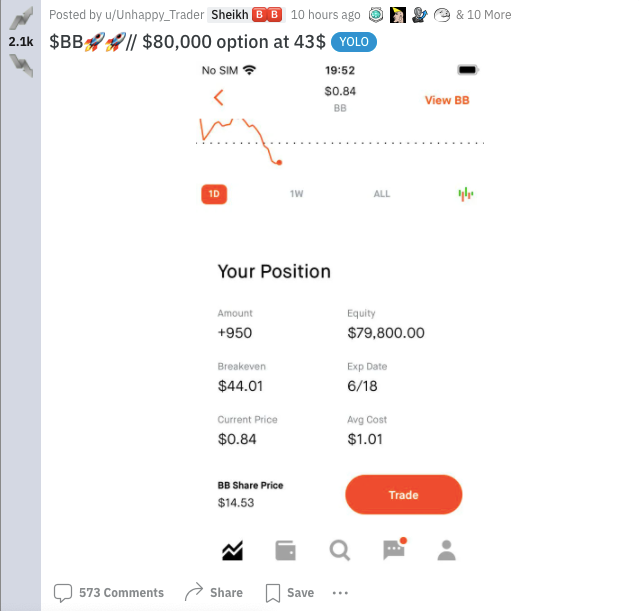

Posters on WSB also showcased their recent investments into the company.

On Thursday, AMC shares tanked nearly 17.9% to $51.34 in the regular session and fell another 7.48% to $47.50 in the after-hours trading in the aftermath of the announcement of an equity sale and warning over volatility from AMC.

On the same day, Blackberry shares were up almost 4.1% to $15.88 in the regular session and rose another 1.39% to $16.10 in the after-hours trading.

See Also: AMC Dizzying Rally On Wednesday Took Company’s Valuation Rocketing Past Rival Stonk GameStop

Why It Matters: AMC shares skyrocketed this week as the retail investor frenzy surrounding them intensified. Since the week’s first trading day, the shares have soared 60%. In terms of year-to-date gains, AMC has returned a whopping 2,321.7%

This week, stonks, or shares favored by retail investors, rose in parallel with AMC, but on Thursday not every stonk was in the green.

Leading stonk GameStop declined 8.52% to $258.18 in the regular session and fell 0.84% in the after-hours trading.

Nokia Oyj (NYSE: NOK), however, resisted the downwards pull and ended Thursday’s regular session 0.55% higher at $5.48. Shares of the Finnish network and 5G company rose 1.09% in the after-hours session to $5.54.

Read Next: AMC Playing The ‘Game’ Lot Better Than GameStop, Says NYU Professor Aswath Damodaran

(C) 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.