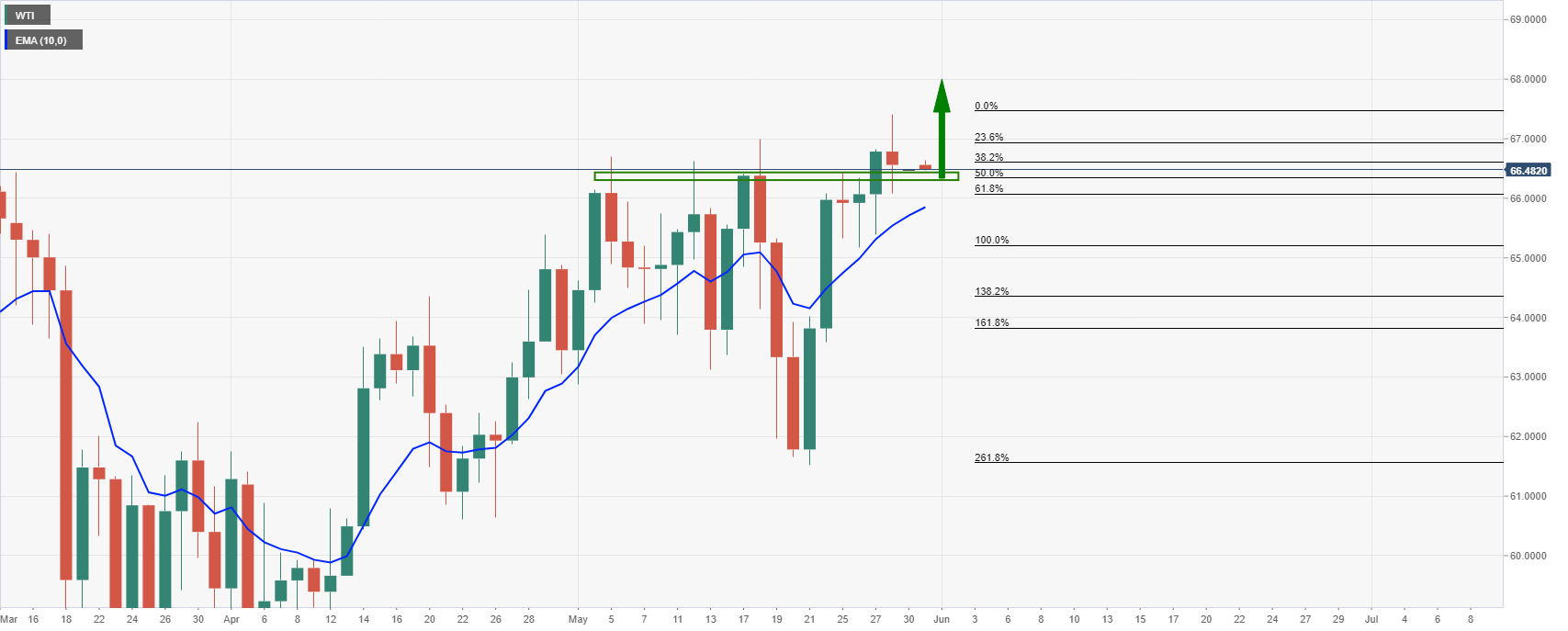

- WTI is testing the bullish commitments for the start of the week.

- A weekly correction could be on the cards if daily support gives out.

- OPEC+ will assess the latest conditions and make a decision on production levels on Tuesday.

Oil prices are flat at the start of the new week in what is expected to be quiet markets considering the holidays in the US.

At the time of writing, the price of WTI is trading at $66.56 and stuck in a narrow $66.56 and $66.72 range following a drop of 0.43% on Friday.

Brent rose 0.27%, to settle at $69.65 a barrel, and US West Texas Intermediate crude fell 0.36%, to settle $66.61 a barrel. Brent and US crude is up 3.57% and 4.31% respectively in May.

However, WTI posted gains for the week and month.

Meanwhile, investors have likely squared their books while in anticipation of the outcome of a key meeting on Tuesday.

OPEC+ will assess the latest conditions and make a decision on production levels.

On the positive front, the positive outlooks for world growth bolstered by strong US economic data have eroded the concerns for the potential gradual increase of Iranian supply.

Elsewhere, concerns are lingering about demand in India, the world’s third-largest oil consumer, which is having to contend with a massive wave of the coronavirus. Only about 3% of its population has been fully vaccinated, according to the Reuters vaccine tracker.

Daily resistance was met by bulls making a fresh daily high of 67.49 on Friday which opens risk to a continuation.

However, in the meantime, a correction would be expected, especially given the bearish close below the prior daily close.

A relatively deep correction, to say the 38.2% Fibonacci of the weekly bullish impulse, comes in at 64.97.