TMB Bank Solid start but stronger quarter still ahead

■ 1Q21 net profit at THB2.8bn, -33% yoy but up 125% qoq, was led by declining provision expense, while topline generation remains soft.

Astec Lifesciences: TP of Rs1,073

We value the company at an eight-year mean valuation as: 1. Core PAT growth will likely be 13.9% CAGR over FY21F-24F. This is lower than FY13-21 PAT growth of 34.7%. We forecast revenue to be 15% CAGR for FY21F-23F, lower than FY13-FY21F revenue growth of 16.2%. While revenue has mimicked past growth, earnings growth is lower and we value the company at a historical mean valuation. We do not assign any premium to it.

Astec’s molecules are facing serious demand issues

• The SBI-triazole market was largely flat in 2019, rising just +0.4% to reach US$3,212m over CY12-19. This market was flat over CY14-19, declining by 2.1% CAGR (Source: IHS Markit). • The impact of COVID-19 is likely to be higher for SBI-triazoles, given a higher relative exposure in the maize and oilseed rape/canola segments, which were impacted somewhat by the downturn in biofuel demand and, therefore, prices in 2020.

Astec Lifesciences Ltd Medium-term headwinds, Hold

■ We forecast revenue growth at 15% CAGR and PAT at 13.9% CAGR over FY21F-24F for Astec Lifesciences ■ The key chemical segment SBI-triazole is facing demand headwinds, but we believe expansion into herbicides provides a growth opportunity.

SCC plan to invest in a new petrochemical complex in Vietnam

In Feb 2012, SCC signed a joint venture agreement with Qatar Petroleum International Vietnam (QPI) and PetroVietnam (wholly owned by the Vietnamese government) to invest in Longson Petrochemical Company (LSP) with the aim to construct a mixed-feed olefins cracker with downstream facilities. Originally, SCC held 46% stake while QPI and PetroVietnam held 25% and 29% stakes, respectively. In Mar 2017, SCC announced to SET that it signed a share purchase agreement with QPI to acquire 25% equity stake in LSP.

Asia propylene price to be supported by strong derivative demand

We estimate that global propylene supply addition should reach 8-9mtpa during 2021-2022F, following naphtha cracker and refinery expansion in China. The startup of propane dehydrogenation projects (PDH) also looks accelerated at 2.8-4.1mtpa during 2021-2022F from 1.0mtpa during 2017-2019. Based on our estimates, 60-90% of additional propylene capacities are from China during 2021-2024F.

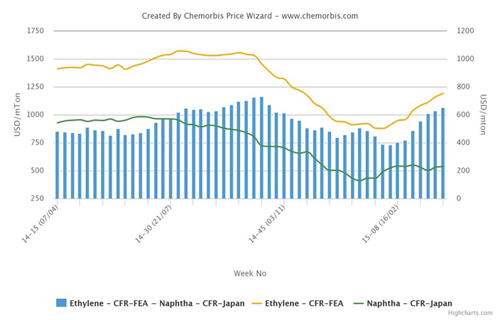

Ethylene-Naphtha spread should remain at US$390-415/t during 2021-2022F

The strong demand for ethylene derivatives, particularly polyethylene (PE), and limited arrival of US cargoes should be able to offset the new supply pressure, in our view. In the case of excess supply, we believe the producers at the high end of the cost curve, such as methanol-based producers, are likely to lose market share to the low-cost players (most likely crude-oil-to-chemical complexes). Post 2023F, ethylene capacity additions should fall to 4-5mtpa.

Thai Petrochemical: New projects starting up at the right time

■ We believe new ethylene capacity is well spread out during 1Q-3Q21F while strong ethylene derivative demand should continue to support ethylene price. ■ Global ethylene capacity addition looks slim post 2022F on limited expansion by US producers and potential delay of some ASEAN projects.

IRPC Big windfall from crude inventory gain

■ As IRPC’s crude inventory holding period is longer than other Thai refiners’, crude inventory gains were likely as high as US$10/bbl in 1Q21F.

Bursa Malaysia: winners and losers

· Financial services – Top net buy sector among local retail investors, has been a net buy sector since the start of 2021. · Consumer products – Second largest net buy sector and has been a net buy sector for the past three weeks.

Bursa Malaysia: Key takeaways from the weekly flows ending 16 Apr 2021

· Local institutional investors turned weekly net buyer after 18 weeks of net selling They net bought RM116.7m of Malaysian equities last week, making them the largest net buyer of Malaysia equities. Retail investors were relegated to the second largest net buyer spot last week. Foreign investors were the only net seller last week and their net sell flows jumped 202% wow to RM235m.

Volpara: The 4Q is traditionally the strongest quarter and we were not disappointed.

Volpara Solid 4Q trading update as expected VHT released a solid 4Q trading update. The 4Q is traditionally the strongest quarter and we were not disappointed. Of most interest was the increase in ARPU to US$1.40 (from US$1.22 in 3Q), however importantly ARPU signed during the quarter on average was US$2.50.

Bursa Malaysia Sectorial Index Series and sector fund flows

· Bursa Malaysia splits the 918 companies listed on the stock exchange into 13 broad sectors. · The performances of the companies listed on the main market in same-sector classifications are captured under the Bursa Malaysia Sectorial Index Series. The inclusion of a company in a sector depends on the company's main source of operating revenue.

PTT Global Chemical: Chemical spread uptrend extended

■ Wider PE-ethane spreads should lead to EBITDA margin expansion. ■ PTT Global Chemical should see more tailwinds from strong prices for propylene derivatives. Asian PE prices supported by strong demand Asian polyethylene (PE) prices were still on the uptrend in early-Apr 21, especially low density polyethylene (LDPE), the price of which increased sharply to US$1,575/t on a supply outage in the Middle East and resilient demand in Asia.

Siam Cement Polymer: spreads to remain strong

■ SCC’s Vietnam-based olefins plant of 1. mtpa should be the company’s long-term EPS growth driver, thanks to feedstock cost competitiveness. ■ Asian PVC-EDC spread was at a 10-year high in Apr 21, which should support SCC’s chemical EBITDA in the near term. Expanded ethylene capacity right on time to capture strong demand SCC’s project to expand ethylene capacity by 300ktpa achieved on-spec production in Mar 21 and started commercial production in Apr 21F.

Livehire Healthy: We maintain the Add rating with an unchanged $0.53 target price

Livehire Healthy pipeline needs converting A largely inline quarterly with slightly higher revenue from the direct sourcing (DS) business and lower cash burn, offset by underwhelming customer growth in DS. Livehire Healthy has detailed a rather healthy pipeline in both business units.

Kasikornbank Looking beyond the near-term noises

■ 1Q21 net profit of THB10.6bn (+44% yoy) was 40% ahead of our estimate from lower-than-expected provisioning and strong recovery in fee income. ■ In our view, concern is likely to turn towards asset quality in the near term, as credit cost is likely to rise in 2Q21F, as borrowers exit its relief programme.

Chularat Hospital: More heart surgery cases to boost margins

More heart surgery cases to boost margins As heart surgery cases are considered high intensity, they provide higher gross margins for CHG. Therefore, even though CHG suffered from lower inpatient revenues in FY20, it still achieved higher gross margin in FY20 as shown below. Note that the ramp-up of CHG’s two greenfield hospitals, Chularat 304 and Chularat Ruampat (RPC) which were opened in 2018, also improved margins in FY20, in our view.

Chularat Hospital Likely to benefit from more referral cases

■ We believe that CHG will benefit not only from performing Covid-19 tests but also from more heart disease patients referred from public hospitals. ■ We raise our core profit forecasts by 6-7% yoy for FY21-23F on the back of more referral cases and revenues from Covid-19 tests.

Handsome Co Ltd Offline growth encouraging

■ Buoyed by strong sales growth from department stores, we forecast Handsome’s offline sales to climb 9.4% in FY21F (vs. -12% in FY20). ■ An increase in the proportion of online sales should improve the company’s overall OP margin in FY21F/FY22F (+9.4%/+9.9% vs. +8.5% in FY20).

Adi Sarana Armada Express growth lifts earnings visibility

■ Adi Sarana Armada Express delivery arm, Anteraja, contributed 23% of revenue in FY20, up nearly six times in less than 2 years, and recorded gross profit in 4Q20. ■ Anteraja is on pace to contribute more than 50% of ASSA’s revenue by FY22F, at 34% 3Y CAGR, reaching BE and boosting ROE starting in FY21F.

Sydney Airport Domestic on the recovery path

Domestic pax is strengthening, with positive forward indications from domestic carriers. Timing of recovery of the more valuable international pax is uncertain. Forecast changes and valuation roll-forward lift our 12 month Target Price by 17 cps to $7.03ps. ADD retained, given 12 month potential TSR of c.17% and 5yr IRR of c.9% pa. In the next 12 months we expect line-of-sight to re-commencement of distributions, benefitting the share price as income-oriented investors return to the stock.

Senex Energy All the right moves

Another consistent and firm quarterly result from SXY in 3Q21, as it builds on its track record as a capable low-cost onshore gas producer. Above-nameplate production from Roma North (19tj/d v 16tj/d) and ramping up Atlas delivered strong group gas sales of 4.6PJ (vs MorgE 4.5PJ). 3Q21 sales revenue A$35.9m (vs MorgE A$36m), average gas price A$6.8/GJ. Roma North expansion by 1Q’FY22 with Atlas expansion to follow once gas contracted to support capex.

Rio Tinto Metal prices offset soft start

Overall a reasonable 1Q21 operational result from Rio Tinto, with lower iron ore shipments and mined copper production as expected. Weather impacted RIO’s operations in 1Q21, in particular its flagship iron ore business in the Pilbara where travel restrictions also created a labour shortage.

HUB24 Flows accelerate: We retain an Add recommendation

Excluding acquisitions (PARS, XPL), HUB reported 3Q21 FUA of A$24.4bn, up 11% for the quarter and up 62% on the pcp. Including acquisitions, HUB now has A$35.6bn of custody FUA and A$15.8bn of non-custody (PARS) FUA.